I was doing a bit of ‘specific purpose’ shopping at a local grocery store to pick up some of their No Name Yogurt. I buy this all the time and use it mixed with fruit, or when making a smoothie with yogurt, milk and berries.

It is worth noting, that some consumers remain staunchly brand-loyal and even brand-dependent.

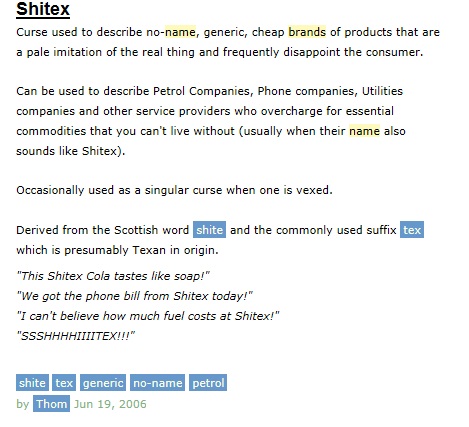

They believe that no-name products are ‘not as good’ as the brand name products that they favor. In reality many no-name brands are manufactured using the same ingredients and at the same factory as the brand product, the only difference being the price and the look of the label. That being said, I’m not ready to trade in my Heinz ketchup for the no-name brand….but Aylmer is a close second. Can you taste the difference?

As I was about to take several tubs (5) off the shelf, I noticed a pad of tear-off coupons right above the yogurt. They were for $1.00 (Cdn) off each tub of No Name Yogurt that you purchased. Since I had 5 tubs in my tote basket, I peeled off 5 coupons. When I got to the check-out, I put the coupons on each tub and the cashier deducted $5.00 off my bill. The regular cost was $1.97 a tub, which would have made the total cost $9.85. I paid $4.85. I was very, very happy. I got the yogurt that I intended to buy, and I got a bargain. Also the empty tubs can be put in recycling bins, or used as food-savers for leftovers.

A friend of mine, Ken, who worked in the food industry, once told me, “Coupons are an easy way for customers to save money. The store does not loose any money, the coupons go right back to the company.”

A few years back, I decided to see if coupons did save me money. Each week I went through the newspapers, magazines, online site and store coupons I had collected as well as free coupon bins in their stores. These bins are there for customers who don’t want to use their coupons, but throw them in a bin so that other customers strolling by can scoop up whatever they want to use. I used an old duo tang notebook to record my savings, a ruler, line paper, and a pen. I drew lines across the page. I also drew lines vertically down the page for categories.

The first category was NUMBER, and then ITEM PURCHASED, then COUPON PRICE, and lastly PRICE TOTAL. I found an old, very large mayonnaise jar with a lid (the kind they used in restaurants that buy in large quantities). I put a slot in the top of the lid so that it was more convenient to drop coins into the jar rather than unscrewing the cap each time.

I labeled the jar, “Coupon Money.” Every time I went to the store and used a coupon, I put the actual money I saved into the jar. It may have been only 35 cents, or 50 cents. Then I recorded the information in my duo-tang.

I decided to do this project for one year. I started in February. I never told anyone what I was doing. If my wife used a coupon, she also added the money to the jar, and recorded the information. Never did I use the proceeds from the jar during the year, but I was tempted many times. Over the months of the year, I took the change that was accumulating and transferred it into bills, starting with $5.00, then $10.00, then $20.00 bills. The idea was to use coupons on products that I normally purchased, not to get 50 cents off a product I wouldn’t normally buy.

I was very diligent with my project that year. It was kind of a game made especially fun when I would get the jar out and look with envy at all the bills stuffed in there.

As the year anniversary was approaching, my wife started telling people about the “Coupon Project.” I heard comments like, “How silly.” “Why would you want to waste your time doing that?” “When I get coupons I throw them out.” “You won’t make any savings on them.” But at the end of the year, the jar contained $520.00. As it turned out, we needed a new couch. We purchased a brand new bed-chesterfield, including delivery, for $500.00

A week later, two friends who had thought that my “Coupon Project” was nonsense, remarked on how beautiful and expensive our couch looked. They asked, “How did you afford to buy such a beautiful couch?” I replied proudly, “coupons.” For the Silo, Blair R. Yager.

Inflation up in aisle three and everywhere else

I loathe getting groceries. I am indecisive, and I have been known to impulse buy.

Surely, I am not alone in that a trip to the grocery store these days is downright depressing. The only highlight is coming across you, the constituents of Haldimand-Norfolk, who brighten the trip. That being said, my sideline conversations are the reason my kids no longer tag along unless I’ve bribed them somehow – let the political corruption jokes begin!

After a busy weekend around the riding, the kids were left with very little in the refrigerator and the cupboards, so I mustered the fortitude to head into town for groceries. Discussion in every aisle turned to the cost of groceries. I picked up a pack of chicken breasts marked at $20 — $20 worth of chicken that would be gobbled up in one sitting with an 18 and 22-year-old. Only half joking, I said to the gentleman next to me that I may as well go out to a fancy restaurant for dinner at that price.

Down another aisle I got chatting with an employee who expressed how frustrating it is to see the prices go up and up. And then she said something to the effect that those in power don’t seem to care. I introduced myself and proceeded to tell her that I agree wholeheartedly.

The latest news for her and everyone doesn’t get any better. The latest data shows inflation increased 3.3 per cent nationally in July. The two main factors in the increase were the price of groceries and gasoline. Groceries were up 8.5 per cent, attributed to mainly fresh fruit and bakery items. On August 16th, gas averaged $1.69 per litre, a week earlier it was $1.63.

The price of gasoline is no surprise to the residents of rural Ontario who need their vehicle to get anywhere. But they also feel the pinch at the stores being that gasoline is integral in the production of food, from tractors to harvesters to transporting food to distribution centres and then back to grocery stores. Fuel prices also add to transportation costs for any commodity, something that those who push carbon taxes seem to forget.

With the increase in inflation, an uptick in interest rates is a possibility come the next Bank of Canada rate announcement on September 6th.

Financial industry leaders have mixed views of the probability of a rate hike. I’m no expert, but from everything I’ve been reading seems to suggest a 50-50 chance of a quarter percentage September hike. I’m not one to sit on the fence, but I’m just going with my gut after trying to extrapolate from the professionals.

And most folks in Haldimand-Norfolk and Ontario aren’t financial experts either, but they do see where the rubber hits the road—food, gas, the cost of borrowing money, and higher prices for critical items.

When I was in Detroit at the beginning of July for the Midwestern Legislative Conference, the talking heads on stage said that surveys conducted across the United States show that the electorate is angry, and they are not sure why. Just five minutes later they spoke about another survey that conveyed taxpayers do not see matters important to them – matters that affect their pocketbook – making it to the floor of legislatures. This is the truth, and the taxpayer is hurting. The electorate feels ripped off and they should be angry.

I will return to Queen’s Park in September and I will do my utmost to bring the issues that matter to you, like the cost of groceries and general cost of living, to the floor of the Legislature.

Bobbi Ann Brady MPP for Haldimand-Norfolk