Breaking a leg is never an easy experience, and even though Canada has free healthcare, there can be other medical bills that come with it and they can be overwhelming. And what happens if you were traveling and had an injury outside of the country- what then? In addition to the physical pain and recovery process, you may also have to worry about how to pay for these other medical expenses. In this article, we’ll explore some of the steps you can take to pay for your doctor’s bills after breaking your leg.

Check Your Insurance Coverage

The first step to take when facing medical bills is to check your insurance coverage. If you have health insurance as an extra, you may be covered for some or all of the expenses associated with your leg injury. Check with your insurance provider to understand the limits and deductibles of your policy. Understand any out-of-pocket expenses, such as co-payments or coinsurance.

Consider Financing Options

Is the payment plan not working for you? No worries! You can find an emergency loan in Canada that can be a viable option to help you pay your bill on time. Many financial institutions and online lenders offer emergency loans for unforeseen expenses, including medical bills. These loans can provide quick access to funds to cover your medical costs, allowing you to focus on recovery.

Before choosing an emergency loan, it’s essential to research your options and compare interest rates and fees to ensure you select the option that works best for your financial situation. Ensure you understand the loan agreement’s terms and conditions before signing up.

Negotiate the Medical Bills

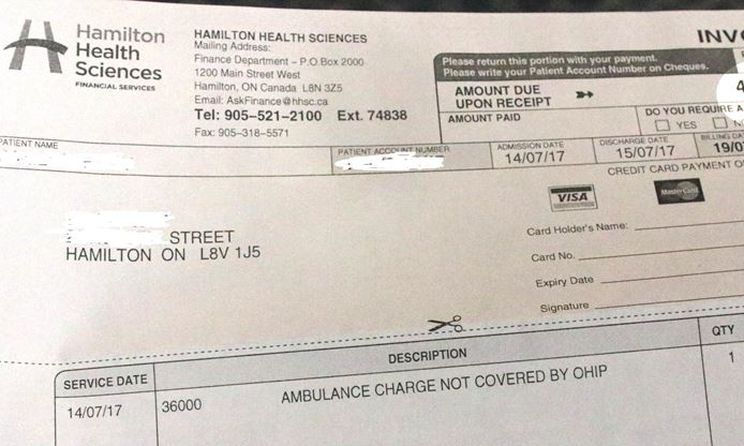

When you receive a bill for medical services related to your leg injury, ask for an itemized bill. This will allow you to see exactly what you’re being charged for such as an ambulance fee and identify any errors or discrepancies. Once you have an itemized bill, you can try negotiating with your healthcare provider or hospital. Explain your situation and ask if they can reduce the bill or set up a payment plan that works for you. If you’re uncomfortable negotiating independently, you can seek assistance from a medical billing advocate or attorney.

Set up a Payment Plan

If you cannot pay your medical bills fully, you can work with your healthcare provider to set up a payment plan. Many providers are willing to work with patients to develop a payment plan that fits their budget. When setting up a payment plan, make sure you understand the terms and conditions. You should know how much you’ll be expected to pay each month, when payments are due, and whether there are any penalties for late payments. Sticking to the payment schedule is vital to avoid accruing late fees or other penalties.

Look for Assistance Programs

Another option you can look for is financial assistance programs from non-profit organizations or government agencies. These programs help individuals who cannot pay for medical services on their own. Research the available options and apply for assistance if you meet the eligibility criteria.

Paying medical bills after you have an injury can be daunting. However, several financing options are available to help you cover your medical expenses. The key is to research your options carefully, compare interest rates and fees, and understand the terms and conditions of any financing agreement before signing up. By doing so, you can effectively manage your medical expenses and focus on your recovery without undue financial stress.