A special ‘Study in Brief’ via our friends at cdhowe.org

- This study estimates the economic benefits of a new, dedicated passenger rail link in the Toronto-Québec City corridor, either with or without high-speed capabilities.

- Cumulatively, in present value terms over 60 years, economic benefits are estimated to be $11-$17 billion under our modelled conventional rail scenarios, and $15-$27 billion under high-speed rail scenarios.

- This study estimates economic benefits, rather than undertaking a full cost-benefit analysis. The analysis is subject to a range of assumptions, particularly passenger forecasts.

Introduction

Canada’s plans for faster, more frequent rail services in the Toronto-Québec City corridor are underway.

In 2021, the federal government announced plans for a new, high frequency, dedicated passenger rail link in the Toronto-Québec City corridor. More recently, the government has considered the potential for this passenger line to provide high-speed rail travel. These two options are scenarios within the current proposed rail project, which VIA-HFR has named “Rapid Train.” This paper analyzes the economic benefits of the proposed Rapid Train project, considering both scenarios, and by implication the costs of forgoing them.

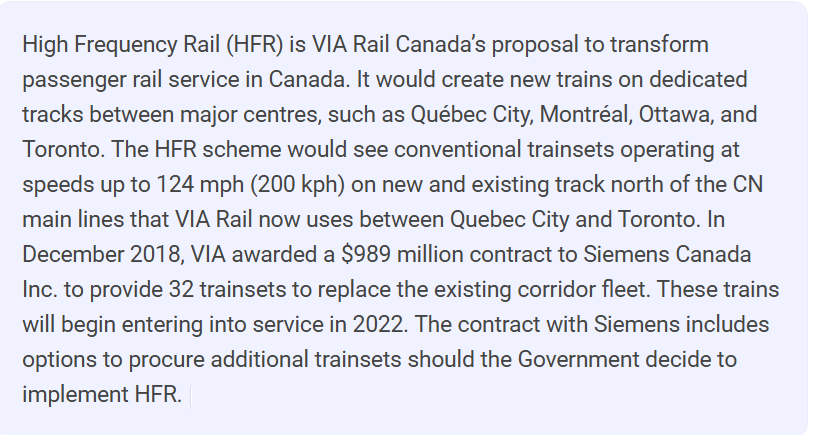

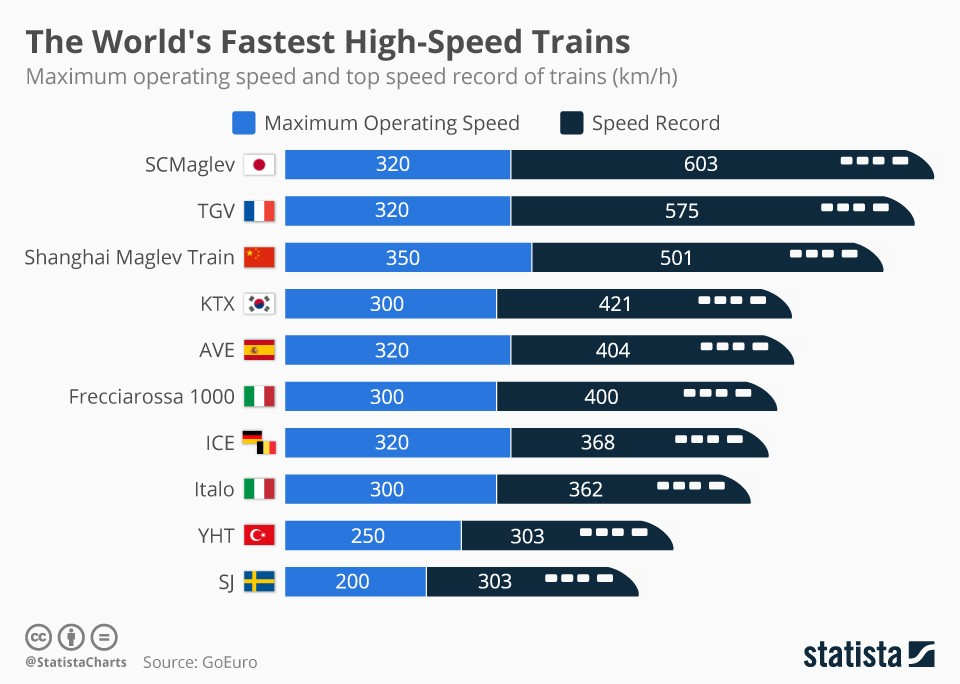

The project offers substantial economic and social benefits to Canada. At a time when existing VIA Rail users must accept comparatively modest top speeds (by international standards) and regular delays, this project offers a dedicated passenger line to solve network capacity constraints. With Canada’s economy widely understood to be experiencing a productivity crisis (Bank of Canada 2024), combined with Canada seeking cost-effective approaches to reducing harmful CO2 emissions, the project offers both productivity gains and lower-emission transportation capacity. There are, in short, significant opportunity costs to postponing or not moving ahead with this investment and perpetuating the status quo in rail service.

The Toronto-Québec City corridor, home to more than 16 million people (Statistics Canada 2024) and generating approximately 41 percent of Canada’s GDP (Statistics Canada 2023), lacks the sort of fully modernized passenger rail service provided in comparable regions worldwide. For example, Canada is the only G7 country without high-speed rail (HSR) – defined by the International Union of Railways (UIC) as a train service having the capability to reach speeds of 250 km per hour. Congestion has resulted in reliability (on time performance) far below typical industry standards. Discussion about enhancing rail service in this corridor has persisted for decades. But delays come with opportunity costs. This Commentary adds up those costs in the event that Canada continues to postpone, or even abandons, investment in enhanced rail services.

The existing rail infrastructure in the Toronto-Québec City corridor was developed several decades ago and continues to operate within parameters set during that time. However, significant changes have occurred since then, including higher population growth, economic development, and shifting transportation patterns. Rising demand for passenger and freight transportation – both by rail and other modes – has increased pressure on the region’s transportation network. There is increasing need to explore the various mechanisms through which enhancements to rail service could affect regional economic outcomes.

According to Statistics Canada (2024), the Toronto-Québec City corridor is the most densely populated and heavily industrialized region in Canada. This corridor is home to 42 percent of the country’s total population and comprises 43 percent of the national labor market. Transport Canada’s (2023) projections indicate that by 2043, an additional 5 million people will reside in Québec and Ontario, marking a 21 percent increase from 2020. This population growth will comprise more than half of Canada’s overall population increase over the period. As the population and economy continue to expand, the demand for all modes of transportation, including passenger rail, will rise. The growing strain on the transportation network highlights the need for infrastructure improvements within this corridor. In 2019, passenger rail travel accounted for only 2 percent of all trips in the corridor, with the vast majority of journeys (94 percent) undertaken by car (VIA-HFR website). This distribution is more skewed than in other countries with high-speed rail. For example, between London and Paris, aviation capacity has roughly halved since the construction of a high-speed rail link (the Eurostar) 25 years ago, which now has achieved approximately 80 percent modal share (Morgan et al. 2025, OAG website 2019). As such, there is potential for rail to have a greater modal share in Canada, particularly as the need for sustainable and efficient transportation solutions becomes more pressing in response to population growth and environmental challenges.

In practical terms, the cost of not proceeding with the Rapid Train project can be estimated as the loss of economic benefits that could have been realized if the project had moved forward. It should be noted that this study does not undertake a full cost-benefit analysis (CBA) of the proposed investment. Rather, it examines the various economic advantages associated with introducing the proposed Rapid Train service in the Toronto-Québec City corridor. Specifically, it analyzes five key dimensions of economic impact: rail-user benefits, road congestion reduction, road network safety improvements, agglomeration effects (explained below), and emission savings. The first three benefits primarily impact individuals who would have travelled regardless, or were induced to travel by rail or car. Agglomeration benefits extend to everyone living in the corridor, while emission savings contribute to both national and international efforts to combat climate change. In each of these ways, enhanced rail services can contribute to regional economic growth and sustainability. By evaluating these aspects, this study aims to develop quantitative estimates of the benefits that enhanced rail services could bring to the economy and society, and by doing so indicate the potential losses that could result from forgoing the proposed rail investment.

Rail user benefits constitute the most direct economic gains. Through faster rail transport with fewer delays, rail users experience reduced travel times, increased service reliability, and improved satisfaction. The Rapid Train project provides rail-user benefits because dedicated passenger tracks would remove the need to give way to freight transport, thus reducing delays. The Rapid Train project would see further benefits with faster routes reducing travel time.

Congestion effects extend beyond individual transportation choices to influence broader economic activity. This study considers how enhanced rail services might affect road congestion levels in key urban centres and along major highways within the corridor. Road network safety is a further aspect of the economic analysis in this study, as modal shift from road to rail could reduce road traffic accidents and their associated economic costs.

Agglomeration economies are positive externalities that arise from greater spatial concentration of industry and business, resulting in lower costs and higher productivity. Greater proximity results in improved opportunities for labour market pooling, knowledge interactions, specialization and the sharing of inputs and outputs (Graham et al. 2009). Improved transportation (both within and between urban areas) can support agglomeration economies by improving connectivity, lowering the cost of interactions and generating productivity gains.1 Supported by academic literature (Graham 2018), these wider economic benefits are included within international transportation appraisal guidance (Metrolinx 2021, UK Department for Transport 2024). Agglomeration effects from enhanced connectivity offer economic benefits distinct from (and additional to) benefits for rail users.

Environmental considerations, particularly emission savings, constitute a further economic benefit. This analysis examines potential reductions in transportation-related emissions and their associated economic value, including direct environmental costs. This examination includes consideration of how modal shifts might influence the corridor’s overall carbon footprint and its associated economic impacts.

The methodology employed in this analysis draws from established economic assessment frameworks while incorporating recent developments in transportation economics. The study utilizes data from VIA-HFR, Statistics Canada, and several other related studies and research papers. Where feasible, the analysis utilizes assumptions that are specific to the Toronto-Québec City corridor, recognizing its unique characteristics, economics, and demographic patterns.

The findings presented here may facilitate an understanding of how different aspects of rail service enhancement might influence economic outcomes across various timeframes and stakeholder groups. This analysis acknowledges that while some benefits may be readily quantifiable, others involve more complex, long-term economic relationships that require careful consideration within the specific context of the Toronto-Québec City corridor.

Based on our modelling and forecasts, the proposals for passenger rail infrastructure investment in the Toronto-Québec City corridor would present substantial economic, environmental, and social benefits (see Table 4 in the Appendix for a full breakdown, by scenario). Our scenario modelling is undertaken over a 60-year period, with new services coming on-stream from 2039, reported in 2024 present value terms. The estimated total of present value benefits ranges from $11 billion in the most conservative passenger growth scenario, to $27 billion in the most optimistic growth scenario. Cumulatively, in present value terms, economic benefits are estimated to be $11-$17 billion under our modelled conventional rail scenarios, and larger – $15-$27 billion – under high-speed rail scenarios. This is subject to a range of assumptions and inputs, including passenger forecasts.

These estimated benefits are built-up from several components. User benefits – stemming from time savings, increased reliability, and satisfaction with punctuality – are the largest component, with an estimated value of $3.1-$9.2 billion. Economic benefits from agglomeration effects (leading to higher GDP) are estimated at $2.6-$3.9 billion, while environmental benefits from reduced greenhouse gas emissions are estimated at $2.6-$7.1 billion. Additional benefits include reduced road congestion, valued between $2.0-$5.9 billion, and enhanced road safety, which adds an estimated $0.3-$0.8 billion. In addition, further sensitivity analysis has been undertaken alongside the main passenger growth scenarios.

Overall, the findings in this study demonstrate and underscore the substantial economic benefits of rail investment in the Toronto-Québec City corridor, and the transformative potential impact on the Toronto-Québec City region from economic growth and sustainable development.

Finally, there are several qualifications and limitations to the analysis in this study. It considers the major areas of economic benefit rather than undertaking a full cost-benefit analysis or considering wider opportunity costs, such as any alternative potential investments not undertaken. It provides an economic analysis, largely building on VIA-HFR passenger forecasts, rather than a full bottom-up transport modelling exercise. Quantitative estimates are subject to degrees of uncertainty.

The Current State of Passenger Rail Services in Ontario and Québec

The Toronto-Québec City corridor is the most densely populated and economically active region of the country. Spanning major urban centres such as Toronto, Ottawa, Montreal, and Québec City, this corridor encompasses more than 42 percent of Canada’s population and is a vital artery for both passenger and freight transport. Despite the significance of the corridor and the economic potential it holds, passenger rail services in Ontario and Québec face numerous challenges, and their overall state remains a topic of debate.

Passenger rail services in the region are primarily provided by VIA Rail, the national rail operator, along with commuter rail services like GO Transit in Ontario and Exo in Québec. VIA Rail operates intercity passenger trains connecting major cities in the Toronto-Québec City corridor, offering an alternative to driving or flying. VIA Rail’s most popular routes include the Montreal-Toronto and Ottawa-Toronto services, which run multiple times per day and serve business travellers, tourists, and daily commuters.

In addition to VIA Rail’s existing medium-to-long-distance services, commuter rail services play a key role in daily transportation for residents of urban centres like Toronto and Montreal. GO Transit, operated by Metrolinx, is responsible for regional trains serving the Greater Toronto and Hamilton Area, while Exo operates commuter trains in the Montreal metropolitan area. These services provide essential links for suburban commuters travelling to and from major employment hubs.

One of the primary challenges facing passenger rail services in Ontario and Québec is that the vast majority of rail infrastructure used by VIA Rail is owned by freight rail companies and is largely shared with freight trains, which means that passenger trains are regularly required to yield to freight traffic. This leads to frequent delays and slower travel times, making passenger rail less attractive compared to other modes of transport, especially for travellers who prioritize frequency, speed and punctuality. The absence of dedicated tracks for passenger rail is a major obstacle in improving travel times and increasing the frequency of service. Without addressing this issue, it is difficult to envisage a significant modal shift towards passenger rail, with cars having greater flexibility, and planes offering faster travel speeds once airborne. Much of the rail network was constructed several decades ago, and despite periodic maintenance and upgrades, it is increasingly outdated in its inability to facilitate higher speeds.

Passenger rail has the potential for low emission intensity. However, some of the potential environmental benefits of rail services in Ontario and Québec have yet to be fully realized. Many existing VIA Rail trains operate on diesel fuel, contributing to greenhouse gas emissions and air pollution. The transition to electrified rail, which would significantly reduce emissions, has been slow, and there is currently no comprehensive plan for widespread electrification of existing VIA Rail passenger rail services in the region.

The current state of rail passenger services in Ontario and Québec – and the opportunities for improvement – have prompted the development of the Rapid Train project along the Toronto-Québec City corridor, which proposes to reduce travel times between major cities and provide a more competitive alternative to air and car travel. The project would also generate significant environmental benefits by reducing greenhouse gas emissions associated with road and air transport. Furthermore, by investing in enhanced rail services, journey times would be further cut, generating additional time savings and associated economic benefits.

Current Government Commitment to Enhanced Rail Services

The Rapid Train project plans to introduce approximately 1,000 kilometres of new, mostly electrified, and dedicated passenger rail tracks connecting the major city centres of Toronto, Ottawa, Montreal, and Québec City. As such, it would be one of the largest infrastructure projects in Canadian history. It is led by VIA-HFR, a Crown corporation that collaborates with several governmental organizations, including Public Services and Procurement Canada, Housing, Infrastructure and Communities Canada; Transport Canada and VIA Rail, all of which have distinct roles during the procurement phases. Subject to approval, a private firm or consortium is expected to be appointed to build and operate these new rail services, via a procurement exercise (see below).

This new rail infrastructure would improve the frequency, speed, and reliability of rail services, making it more convenient for Canadians to travel within the country’s most densely populated regions. The project has the potential to shift a significant portion of travel from cars (which currently account for 94 percent of trips in the Toronto-Québec City corridor) to rail (which represents just 2 percent of total trips).

The project also seeks to contribute to Canada’s climate goals by reducing greenhouse gas emissions. Electrified trains and the use of dual-powered technology (for segments of the route that may still require diesel) will significantly reduce the environmental footprint of intercity travel. The project is expected to improve the experience for VIA Rail users, as dedicated passenger tracks will reduce delays caused by freight traffic, offering passengers faster, more frequent departures, and shorter travel times.

Beyond environmental benefits, the project is expected to stimulate economic growth by creating new jobs in infrastructure development, supporting new economic centres, and enhancing connectivity between cities, major airports, and educational institutions.

The project is currently at the end of the procurement phase, following the issuance of a Request for Proposals (RFP) in October 2023. Through the procurement exercise, a private-sector partner will be selected to co-develop and execute the project. The design phase, which may last four or more years, will involve regulatory reviews, impact assessments, and the development of a final proposal to the government for approval. Once constructed, passenger operations are expected to commence by 2040.

The Rapid Train project also offers opportunities to improve services on existing freight-owned tracks. VIA Rail’s local services, which currently operate between these major cities, will benefit from integration with this project. Although final service levels are not yet determined, the introduction of a new dedicated passenger rail line is expected to enable VIA Rail to optimize operating frequencies and schedules, leading to more responsive and efficient service for passengers. In turn, this will mean that departure and arrival times can be adjusted to better suit travellers’ needs, reducing travel times and increasing the attractiveness of rail as a mode of transportation for both leisure and business. As many of VIA Rail’s existing passenger services switch onto dedicated tracks, there is potential to free up capacity on the existing freight networks. As such, freight rail traffic may benefit from reduced congestion, supporting broader economic growth by easing supply chains and by improving the efficiency of goods transportation across Canada.

The project design will enable faster travel compared to existing services, but as the co-development phase progresses, it will examine the possibility of achieving even higher speeds on certain segments of the dedicated tracks. Achieving higher speeds is not guaranteed, due to the extensive infrastructure changes required and its associated costs, e.g., full double-tracking and the closure of approximately 1,000 public and private crossings. However, the project design currently incorporates flexibility to explore higher speeds where there may be opportunities for operational and financial efficiencies and additional user benefits.

The current Rapid Train project proposal seeks to achieve wider social and government objectives. In the context of maintaining public ownership, private-sector development partners will be required to respect existing labor agreements. VIA Rail employees will retain their rights and protections, with continuity ensured under the Canada Labour Code and relevant contractual obligations.

International Precedent

High-Speed Rail (HSR) already exists in many countries, with notable examples of successful implementation in East Asia and Europe. As of the middle of 2024, China has developed the world’s largest HSR network spanning over 40,000 kilometres, followed by Spain (3,661 km), Japan (3,081 km), and France (2,735 km) (Statista 2024). Among the G7 nations, Canada stands as the only country without HSR infrastructure, albeit the United States maintains relatively limited high-speed operations through the Acela Express in the Northeast Corridor. Recent significant HSR developments include China’s Beijing-Shanghai line (2,760 km), which is the world’s longest HSR route. In Europe, the UK’s High Speed 1 (HS1) connects London to mainland Europe via the Channel Tunnel. Italy has extended its Alta Velocità network with the completion of the Naples-Bari route in 2023, significantly reducing travel times between major southern cities (RFI 2023). Morocco recently became the first African nation to implement HSR with its Al Boraq service between Tangier and Casablanca (OCF 2022). In Southeast Asia, Indonesia’s Jakarta-Bandung HSR, completed in 2023, is the region’s first HSR system (KCIC 2023). India is installing the Mumbai-Ahmedabad HSR corridor, the country’s first bullet train project, which is scheduled to commence partial operations by 2024 (NHSRCL 2023).

The economic impacts of HSR have been extensively studied, particularly in Europe. In Germany, Ahlfeldt and Feddersen (2017) analyzed the economic performance of regions along the high-speed rail line between Cologne and Frankfurt: the study found that, on average, six years after the opening of the line, the GDP of regions along the route was 8.5 percent higher than their estimated counterfactual. In France, Blanquart and Koning (2017) found that the TGV network catalyzed business agglomeration near station areas, with property values increasing by 15-25 percent within a 5km radius of HSR stations. An evaluation of the UK’s HS1 project estimated cumulative benefits of $23-$30 billion (2024 prices, present value, converted from GBP) over the lifetime of the project, excluding wider economic benefits (Atkins 2014).

Modal shift and passenger growth is a critical driver of economic benefits. The Madrid-Barcelona corridor in Spain provides an example: HSR captured over 60 percent of the combined air-rail market within three years of operation, demonstrating that HSR can have a competitive advantage over medium-distance air travel (Albalate and Bel 2012). However, analysis by the European Court of Arbiters (2018) suggests that HSR routes require certain volumes of passengers (estimated at nine million) to become net beneficial, and while some European HSR routes have achieved this level (including the Madrid-Barcelona route), others have not. In the US, the Amtrek Acela service between Boston and Washington D.C. is estimated to have 3-4 million passengers (Amtrek 2023). For some high-speed rail lines, passenger volumes are supported by government environment policy. For example, Air France was asked directly by the government to reduce the frequency of short haul flights for routes where a feasible rail option existed (Reiter et al. 2022). Overall, passenger growth constitutes a key assumption regarding the benefits derived from the Rapid Train project.

Regarding the environmental benefits of HSR, a detailed study by the European Environment Agency (2020) found that HSR generates approximately 14g of CO2 per passenger-kilometre, compared to 158g for air travel and 104g for private vehicles. In Japan, the Central Japan Railway Company reports that the Shinkansen HSR system consumes approximately one-sixth the energy per passenger-kilometre compared to air travel. The UIC’s Carbon Footprint Analysis (2019) demonstrated that HSR infrastructure, despite high initial carbon costs during construction, typically achieves carbon neutrality within 4-8 years of operation through reduced emissions from modal shift.

Socioeconomic benefits of HSR extend beyond direct impacts on rail users. In Spain, the Madrid-Barcelona high-speed rail line enhanced business interactions by allowing for more same-day return trips and improved business productivity (Garmendia et al. 2012). Research has found that Chinese cities connected by HSR experienced a 20 percent increase in cross-regional business collaboration, providing potential evidence of enhanced knowledge spillovers and innovation diffusion (Wang and Chen 2019).

However, the implementation of HSR is not without challenges. Flyvbjerg’s (2007) analysis of 258 transportation infrastructure projects found that rail projects consistently faced cost overruns averaging approximately 45 percent. For example, the costs of the California High-Speed Rail project in the United States rose from an initial estimate of $33 billion in 2008 to over $100 billion by 2022, highlighting the importance of realistic cost projections and robust project management.

Positive labor market impacts are also evident, although varied by region. Studies in Japan by Kojima et al. (2015) found that cities served by Shinkansen experienced a 25 percent increase in business service employment over a 10-year period after connection. European studies, particularly in France and Spain, show more modest but still positive employment effects, with employment growth rates 2-3 percent higher in connected cities compared to similar unconnected ones (Crescenzi et al. 2021).

For developing HSR networks, international experience suggests several critical success factors. These include careful corridor selection based on population density and economic activity, integration with existing transportation networks, and sustainable funding mechanisms. The European Union’s experience, documented by Vickerman (2018), emphasizes the importance of network effects in finding that the value of HSR increases significantly when it connects multiple major economic centres.

Methodology

This study integrates data from VIA-HFR, Statistics Canada, prior reports on rail infrastructure proposals in Canada, and related studies, to build an economic assessment of potential benefits of the proposed Rapid Train project. Key assumptions throughout this analysis are rooted in published transportation models, modelling guidelines, and an extensive body of research. The methodology draws extensively from the Business Case Manual Volume 2: Guidance by Metrolinx, which itself draws upon the internationally recognized transportation appraisal guidelines set by the UK government’s Department for Transport (DFT). These established guidelines offer best practices and standards that provide a structured and reliable framework for estimating benefits. By aligning with proven methodologies in transportation and infrastructure project appraisal, this study ensures rigor and robustness within the economic modelling and analysis.

The proposed route includes four major stations: Toronto, Ottawa, Montréal, and Québec City. These major urban centres are expected to experience the most significant ridership impacts and related benefits. There are three further stations on the proposed route – Trois-Rivières, Laval, and Peterborough – although these are anticipated to have a more limited effect on the overall modelling results, due to their smaller populations. Based on forecast ridership data provided by VIA-HFR for travel between the four main stations, our model designates these areas as four separate zones to facilitate the benefit estimation. Figure 1 below illustrates the proposed route for the Rapid Train project and highlights the different zones modeled in this analysis.

According to current VIA-HFR projections, the routes are expected to be operational between 2039 and 2042. In line with typical transport appraisals, this paper estimates and monetizes economic and social benefits of the project over a 60-year period, summing the cumulative benefits from 2039 through to 2098, inclusive. To calculate the total present value (as of 2024) of these benefits, annual benefits are discounted at a 3.5 percent social discount rate, in line with Metrolinx guidance, and then aggregated across all benefit years.

Our model examines multiple scenarios to assess the range of potential benefits under various conditions. The primary scenarios within the Rapid Train project are for Conventional Rail (CR) and High-Speed Rail (HSR). These scenarios are distinguished by differences in average travel time, with HSR benefiting from significantly faster speeds than CR, and therefore lower travel times (see Table 2).

Within each of these scenarios, we consider three sub-scenarios from VIA-HFR’s modelled passenger projections – central, downside and upside – plus a further sub-scenario (referred to as the 2011 feasibility study in the Figures) based on previous modelled estimates of a dedicated passenger rail line in the corridor. The central sub-scenario provides VIA-HFR’s core forecast for passenger growth under CR and HSR. The upside sub-scenario reflects VIA-HFR’s most optimistic assumptions about passenger demand, while the downside represents the organisation’s more cautious assumptions.

The use of VIA-HFR’s passenger projections is cross-checked in two ways: First, our analysis models an alternative passenger growth scenario (2011 feasibility study), which is based upon the projected growth rate for passenger trips as outlined in the Updated Feasibility Study of a High-Speed Rail Service in the Québec City – Windsor Corridor by Transport Canada (2011).2 The analysis in that study was undertaken by a consortium of external consultants. Second, we have reviewed passenger volumes in other jurisdictions (discussed above and below).

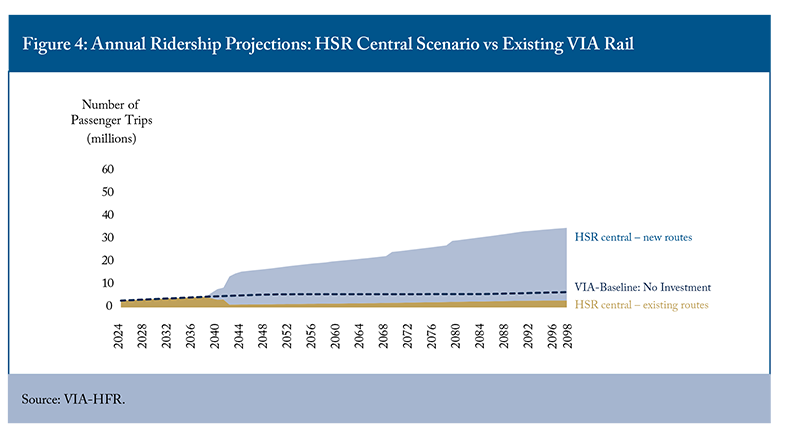

In the absence of investment in the Rapid Train project, VIA-HFR’s baseline scenario passenger demand projections indicate approximately 5.5 million trips annually by 2050 using existing VIA Rail services in the corridor. In contrast, with investment, annual projected demand for CR ranges from 8 to 15 million trips, and for HSR between 12 and 21 million trips by 2050, across all the sub-scenarios described above. Figures 2 and 3 illustrate these projected ridership figures under CR and HSR scenarios across each sub-scenario, as well as compared to the baseline scenario.

Under the CR and HSR scenarios, while the vast majority of rail users are expected to use the new dedicated passenger rail services, VIA-HFR passenger forecasts indicate that some rail users within the corridor will continue to use services on the existing VIA Rail line, for example, due to travelling between intermediate stations (Kingston-Ottawa). The chart below illustrates the breakdown of benefits under the central sub-scenario for high-speed rail.

User Benefits

User benefits in transportation projects such as CR/HSR can be broadly understood as the tangible and intangible advantages that rail passengers gain from improved services. These benefits encompass the value derived from time saved, enhanced reliability, reduced congestion, and improved overall travel experience. For public transit projects like CR/HSR, user benefits are often key factors in justifying the investment due to their broad social and economic impact.

Rail infrastructure projects can reduce the “generalized cost” of travel between areas, which directly benefits existing rail users, as well as newly induced riders. The concept of generalized cost in transportation economics refers to the total cost experienced by a traveller, considering not just monetary expenses (like ticket prices or fuel) but also non-monetary factors such as travel time, reliability, comfort, and accessibility.

Investments that improve transit may reduce generalized costs in several ways. Consistent, on-time service lowers the uncertainty, inconvenience and dissatisfaction associated with delays. More frequent services provide passengers with greater flexibility and reduced waiting times. Reduced crowding can offer more comfortable travel, reducing the disutility associated with congested services. Enhanced services like better seating, Wi-Fi, or improved station facilities may increase user satisfaction. Better access to transit stations or stops may allow for easier integration into daily commutes, increasing the convenience for existing and new travellers. Faster travel can reduce travel time, which is often valued highly by passengers.

In this paper, user benefits are estimated based on three core components: travel time savings based on faster planned journey times, enhanced reliability (lower average delays on top of the planned journey time), and the psychological benefit of more reliable travel. In our analysis, the pool of users is comprised of the existing users who are already VIA Rail passengers within this corridor, plus new users who are not prior rail passengers. Within this category of new users there are two sub-groups. First, new users include individuals who are forecast to switch to rail from other modes of transport, such as cars, buses, and airplanes – known as “switchers.” Second, new users also include individuals who are induced to begin to use CR/HSR as a result of the introduction of these new services – known as “induced” passengers. Overall, this approach captures the comprehensive user benefits of CR/HSR, recognizing that time efficiency, increased dependability, and greater customer satisfaction hold substantial value for both existing and new riders. The split of new users across switchers and induced users – including the split of induced users between existing transport modes, primarily road and air – is based on the federal government’s 2011 feasibility study, although the modelling in this Commentary also undertakes sensitivity analysis using VIA-HFR’s estimates for these proportions. The approach to estimating rail-user benefits is discussed below.

The modelling in this study incorporates projections of passenger numbers for both existing VIA Rail services (under a ‘no investment’ scenario) and for the proposed CR/HSR projects, sourced from VIA-HFR transport modelled forecasts. This enables the derivation of forecasts for both existing and new users.

In line with the formula (above) for user benefits, this study estimates the reduction in generalized costs (C1 – C0 ) arising from the new CR/HSR transportation service. Since the ticket price for the proposed CR/HSR is still undetermined, we have not assumed any changes versus current VIA Rail fares, although this is discussed as part of sensitivity analysis. The model reflects a reduction in generalized costs attributed to shorter travel times and enhanced service reliability under CR/HSR. Table 2 shows a comparison of the average scheduled journey times (as of 2023) for existing VIA Rail services, compared to forecast journey times under the proposed CR/HSR services, across different routes.

In addition to travel time savings based on scheduled journey times, an important feature of the CR/HSR project is that a new, dedicated passenger rail line can reduce the potential for delays. To estimate the reduction in travel delays under CR/HSR, we first calculated a lateness factor for both existing VIA Rail and the proposed CR/HSR, based on punctuality data and assumptions. Current data indicate that VIA Rail services are on time (reaching the destination within 15 minutes of the scheduled arrival time) for approximately 60 percent of journeys. Therefore, VIA Rail experiences delays (arriving more than 15 minutes later than scheduled) approximately 40 percent of the time. Data showing the average duration of delays are not available, and therefore we estimate that each delay is 30 minutes on average, based on research and discussions with stakeholders. CR/HSR would provide a dedicated passenger rail service, which would have a far lower lateness rate. Our model assumes CR/HSR would aim to achieve significantly improved on-time performance, with on-time arrivals (within 15 minutes) for 95 percent of journeys (Rungskunroch 2022), which equates to 5 percent (or fewer) of trains being delayed upon arrival.

Combined, there are time savings to users from both faster scheduled journeys and fewer delays. The estimated travel time savings are derived from the difference between the forecast travel times of CR/HSR and the average travel times currently experienced with VIA Rail. The value of time is monetized by applying a value of $21.45 per hour, calculated by adjusting the value of time recommended by Business Case Manual Volume 2: Guidance-Metrolinx ($18.79 per hour, in 2021 dollars) to 2024 dollars using the Consumer Price Index (CPI). This value remains constant (in real terms) over our modelling period.

There is an additional psychological cost of unreliability associated with delays. Transport appraisal guidelines and literature typically ascribe a multiplier to the value of time for unscheduled delays. The modelling in this study utilizes a multiplier of 3 for lateness, which is consistent with government transport appraisal guidance in the UK and Ireland (UK’s Department for Transport 2015, Ireland’s Department of Transport 2023). Some academic literature finds that multipliers may be even higher, although it varies according to the journey distance and purpose (Rossa et al. 2024). Overall, the lateness adjustment increases the value to rail users of CR/HSR due to its improved reliability and generates a small uplift to the total user benefits under CR/HSR.

The modelling combines these user benefits and makes a final adjustment to net off indirect taxes, ensuring that economic benefits are calculated on a like-for-like basis with costs incurred by VIA-HFR (Metrolinx 2021). Individual users’ value of time implicitly takes into account indirect taxes paid, whereas VIA-HFR’s investments are not subject to indirect taxation. Ontario’s rate of indirect taxation (13 percent harmonized sales tax rate) has been used in the modelling (Metrolinx 2021).

The modelling does not assume any variation in ticket prices under the proposed CR/HSR services, relative to existing VIA Rail services. User benefits in the analysis are derived purely from the shorter journey times and improved reliability. This approach enables the estimation, in the first instance, of the potential benefits from time savings and reliability. While CR/HSR ticket prices are not yet determined, it is nevertheless possible to consider the impact of changes to ticket prices as a secondary adjustment, which is discussed in the sensitivity analysis further below.

Congestion and Safety on the Road Network

In addition to rail-user benefits, the proposed CR/HSR project would also provide benefit to road users via decongestion and a potential reduction in traffic accidents.

When new travel options become available, such as improved rail services, some travellers shift from driving to using transit, reducing the number of vehicles on the road. This reduction in vehicle-kilometres travelled (VKT) decreases road congestion, providing benefits to the remaining road users. Decreased congestion leads to faster travel times, and can also lower vehicle operating costs, particularly in terms of fuel efficiency and vehicle wear-and-tear.

Our research model includes a forecast of how improvements in rail travel could lead to decongestion benefits for auto travellers in congested corridors. Through CR/HSR offering a faster and more reliable journey experience versus existing VIA Rail services, VIA-HFR’s passenger modelling forecasts shifts in travel patterns, with a significant proportion of new rail users being switchers from roads. These shifts reduce road congestion and in turn generate welfare benefits for those continuing to use highways.

Analysis of Canadian road use data, cross-checked with more granular traffic data from the UK, suggests that the proportion of existing road VKT is 37 percent in peak hours and 63 percent in off-peak hours, based on Metrolinx’s daily timetable of peak versus non-peak hours (Metrolinx 2021, Statistics Canada 2014, Department for Transport 2024). Using this information, the estimated weighted average impact of road congestion is approximately 0.004 hours/VKT. Time savings are converted into monetary values (using $21.45/hour, in 2024 dollars) to estimate the economic benefits of reduced road congestion.

In practice, road networks are unlikely to decongest by the precise number of transport users who are forecast to switch from road to rail. First, the counterfactual level of road congestion (without CR/HSR) will change over time, as a function of population growth, investment in road networks (such as through highway expansion), developments in air transport options, and wider factors. Many of these factors are not known precisely (e.g., investment decisions regarding highways expansion across the coming decades), therefore the counterfactual is necessarily subject to uncertainty. Second, if some road users switch to rail due to investment in CR/HSR, the initial (direct) reduction in congestion would reduce the cost of road travel, inducing a subsequent (indirect) “bounce-back” of road users (known as a general equilibrium effect). The modelling of congestion impacts in this study is necessarily a simplification, focusing on the direct impacts of decongestion, based on the forecast number of switchers from road to rail.

In addition to decongestion, CR/HSR may also improve the overall safety of the road network through fewer vehicle collisions. Collisions not only cause physical harm but also cause economic and social costs. These include the emotional toll on victims and families, lost productivity from injuries or fatalities, and the costs associated with treating accident-related injuries. Road accidents can cause disruptions that delay other travellers, adding additional economic costs, and can also incur greater public expenditure through emergency responses.

With CR/HSR expected to shift some users from road to rail, this study models the forecast reduction in overall road VKT. This estimate for the reduction in road VKT is converted into a monetary value assuming $ 0.09/VKT in 2024 prices, which is discounted in future years by 5.3 percent per annum to account for general safety improvements on the road network over time (such as through improvements in technology) and fewer accidents per year (Metrolinx 2018, Metrolinx 2021).

Agglomeration

Agglomeration economies are the economic benefits that arise when firms and individuals are located closer to one another. This generates productivity gains which are additional to direct user benefits. These gains can stem from improved labor market matching, knowledge spillovers, and supply chain linkages, benefiting groups of firms within specific industries (localization economies) as well as across multiple industries (urbanization economies). Where businesses cluster more closely – such as within dense, urbanized environments – these businesses benefit from proximity to larger markets, varied suppliers, and accessible public services. For instance, if a manufacturing firm relocates to an urban hub such as Montreal, productivity benefits may ripple across industries as the economic density and activity scale of the area increases. Agglomeration can enable longer-term economic benefits, through collaboration across businesses, universities, and research hubs, stimulating research and development, supporting innovation and enabling new industries to develop and grow.

Transport investments generate economic benefits and increase productivity through urbanization and localization economies. Urbanization economies (Jacobs 1969) refer to benefits arising from a business being situated in a large urban area with a robust population and employment base. This type of agglomeration allows firms to leverage broader markets and infrastructure advantages, thus achieving economies of scale that are independent of industry. Conversely, localization economies (Marshall 1920) focus on productivity gains within a specific industry, where firms in close proximity can cluster together to benefit from a specialized labor pool and more efficient supply chains. For example, as multiple manufacturing firms cluster within an area, their proximity allows them to co-create a specialized workforce and share industry knowledge, creating productivity gains unique to that industry.

In practice, improved transportation can generate agglomeration effects in two ways; first is “static clustering”, where improvements in connectivity facilitate greater movement between existing clusters of businesses and improved labor market access, without changing land use. For individuals and businesses in their existing locations, enhanced connectivity reduces the travel times and the costs of interactions, so people and businesses are effectively closer together and the affected areas have a higher effective density.

Second, “dynamic clustering” can occur when transport investments alter the location or actual density of economic activity. Dynamic clustering can lead to either increased or decreased density in certain areas, impacting the overall productivity levels across regions by altering labor and firm distributions. Conceptually, dynamic clustering’s benefits include the benefits from static clustering.

The analysis in this study is based on static clustering effects, focusing on productivity benefits arising from improved connectivity without modelling potential changes in land use or actual density. This approach estimates the direct economic gains of reduced travel times and enhanced accessibility within existing urban and industrial structures. Benefits arising from dynamic clustering are subject to greater uncertainty because it may involve displacement of economic activity between regions. In addition, variations in density across regions could be influenced by external factors – such as regional economic policies, housing availability, or industry-specific demands – that would require a much deeper and granular modelling exercise. Overall, focusing on static clustering provides a more conceptually conservative estimate of the benefits.

To estimate the agglomeration economies associated with the CR/HSR project, we utilize well-established transport appraisal methodology for agglomeration estimation (Metrolinx 2021). The analysis in this study applies one simplification to accommodate data availability, which is to undertake the analysis at an economy-wide level, rather than performing and aggregating a series of sector-specific analyses.

Overall, the three-step model estimates these agglomeration effects through changes in GDP. In the first step, the generalized journey cost (GJC) between each zone pair is calculated. This GJC serves as an average travel cost across various transportation modes (e.g., road, rail, air), taking account of journey times and ticket prices. The GJC is estimated for both the baseline (existing VIA Rail) and investment scenarios (CR/HSR), across multiple projection years. Due to the sensitivity of agglomeration calculations, in the baseline the GJC for CR/HSR, road and air are assumed to be equivalent, and in the investment scenario the GJC for road and rail are reduced by utilizing the rule of half principle (see Figure 5). The baseline utilizes Canada-wide vehicle kilometre data from Statistics Canada to estimate passenger modal shares (across existing VIA Rail, road, and air) for 2024, with the modal shares remaining constant over time in the baseline (Transport Canada 2021, Transport Canada 2018, Statistics Canada 2016). In the scenarios, the modal shares are adjusted for passengers moving from existing VIA Rail (and other transport modes) to CR/HSR, as well as induced passengers.

In the second step, the effective density of each of the four zones is calculated under all scenarios. Effective density increases in the investment scenarios because CR/HSR reduces the GJC and enhances connectivity between zones.

In the third step, changes in effective density between scenarios are converted into productivity gains measured as changes in GDP, utilizing a decay parameter of 1.8 and an agglomeration elasticity of 0.046 (Metrolinx 2021). The decay parameter (being greater than 1) diminishes the agglomeration benefits between regions that are further away from each other, such that the estimated productivity gains (arising from greater connectivity) are higher for areas that are closer together. The agglomeration elasticity is – based on academic literature – the assumed sensitivity of GDP to changes in agglomeration. Approximately, an elasticity of 0.046 assumes that a 1 percent increase in the calculated estimate for effective density (see step 2) would correspond to a 0.046 percent increase in GDP. Data on GDP and employment are sourced from Statistics Canada’s statistical tables, and forecast employment growth is assumed to align with Statistics Canada’s projected population growth rates.

Emissions

Environmental effects from transportation create a further source of economic impact. This study considers the main dimensions – greenhouse gas (GHG) emissions and air quality – each contributing to external welfare impacts that affect populations and ecosystems.

Transportation accounts for approximately 22 percent of Canada’s GHG emissions (Canada’s 2024 National Inventory Report), primarily through automobile, public transit, and freight operations. Emissions from GHGs, particularly carbon dioxide, significantly impact the global climate by contributing to phenomena such as rising sea levels, shifting precipitation patterns, and extreme weather events. The social cost of carbon (SCC) framework, published by Environment and Climate Change Canada, assigns a monetary value to these emissions, reflecting the global damage caused by an additional tonne of CO₂ released into the atmosphere. The federal government’s SCC values were published in 2023, more recently than the values recommended by Metrolinx’s 2021 guidance, and therefore the government’s values are used for the modelling in this study. For SCC, data from Environment and Climate Change Canada’s Greenhouse Gas Estimates Table are used, adjusted to 2024 values using CPI. Within the modelling, SCC values increase from $303.6 (in 2024) to $685.5 (in 2098). Using SCC in cost-benefit analyses enables more informed decisions on transportation investments by calculating the welfare costs and benefits associated with emissions under both investment and business-as-usual scenarios.

A wider set of pollutants emitted by vehicles – including CO, NOx, SO₂, VOCs, PM10s, and PM2.5s – pose further health risks, causing respiratory issues, heart disease, and even cancer. These harmful compounds, classified as Criteria Air Contaminants (CACs), impact individuals living or working in the vicinity of transport infrastructure, leading to external societal costs that are not fully perceived by direct users of the transport network. Health Canada’s Air Quality Benefits Assessment Tool (AQBAT) quantifies the health impacts of CACs, evaluating the total economic burden of poor air quality through a combination of local pollution data and Concentration Response Functions (CRFs), linking pollutants to adverse health effects. Furthermore, AQBAT considers air pollution’s effects on agriculture and visibility, allowing analysts to estimate the overall benefits of reducing transport-related emissions for communities across Canada.

This study identifies that CR/HSR has the potential to reduce emissions across multiple fronts. First, as an electrified rail system, CR/HSR is capable of operating with zero emissions, providing a cleaner alternative to existing rail services. If VIA Rail discontinues some services on overlapping routes with CR/HSR, emissions from rail transport in those areas would decrease, as per its planning forecasts. Additionally, CR/HSR’s higher speeds and greater reliability are expected to attract more passengers over time, encouraging a modal shift from more carbon-intensive forms of transportation, such as cars and airplanes. This anticipated shift would lead to a reduction in overall emissions from private vehicle and regional air travel, contributing to CR’s/HSR’s positive environmental impact.

By incorporating SCC and AQBAT metrics, the analysis offers a holistic appraisal of the environmental and social benefits of reducing emissions and improving air quality through CR/HSR, capturing the external welfare consequences beyond direct user impacts. Unit costs of CACs (see Table 3 below) are sourced from Metrolinx (2021) and are also adjusted by CPI into 2024 prices.

Results and Analysis

This section sets out the potential benefits of CR/HSR across various scenarios and sub-scenarios, spanning the 60-year period project implementation (2039 to 2098, inclusive). Results are reported in 2024 present value terms, cumulated over the 60-year period, as per cost-benefit analysis (CBA) literature (e.g., Metrolinx 2021). This cumulative present value represents the total value of benefits to 2098, with benefits in future years discounted to 2024 values. Figure 6 below illustrates the total cumulative present value of benefits for the proposed CR/HSR project, under different scenarios and passenger growth sub-scenarios in our model.

Since the HSR upside is the most optimistic sub-scenario, with a higher speed and the highest projected growth rate for rail passengers, it yields the largest total economic benefit, estimated at approximately $27 billion. Conversely, the CR downside assumes a comparatively lower speed and a smaller growth rate for rail passengers, resulting in the lowest benefit among all sub-scenarios, estimated at around $11 billion. This range of outcomes highlights that economic benefits are sensitive to assumptions around speed and passenger growth, underscoring the importance of these factors in the overall project evaluation.

Figure 7 illustrates the breakdown of benefits from the proposed CR/HSR project across different sub-scenarios and categories of benefits (see Table 4 in the Appendix for numerical values). User benefits form the largest component, indicating that rail passengers are expected to gain approximately $3.1–$9.2 billion in value over the modelling period, in present-day terms. Road decongestion effects, agglomeration impacts and emissions reductions are also forecast to deliver economic benefits. This study’s modelling estimates that CR/HSR could generate agglomeration effects that boost GDP by around $2.6–$3.9 billion over the 60-year analysis period, through enhancing productivity in the Ontario-Québec corridor. CR/HSR could significantly reduce greenhouse gas emissions and improve air quality, valued at approximately $2.6–$7.1 billion when considering the social cost of carbon and other pollutants. Benefits from reduced congestion on roads are estimated at $2.0–$5.9 billion. Finally, improved road safety offers an additional $0.3–$0.8 billion (approximately) in present value. Together, these impacts illustrate the wide-ranging economic, environmental, and social benefits anticipated from the CR/HSR project.

Given the potential sensitivity of economic benefits to assumptions around passenger growth, the 2011 federal government feasibility study provides a useful point of comparison for rail passenger growth under CR/HSR. The current outlook for rail passenger forecasts is not the same as it was in 2011, but some of the changes will have offsetting impacts. On one hand, Canada’s population has both grown faster (between 2011 and 2024) and is expected to grow faster in the future, relative to expectations in 2011. On the other hand, remote working has increased significantly since the COVID-19 pandemic. Passenger forecasts are discussed in more detail below.

Modelled agglomeration benefits are at the upper end of expectations. For example, the value of agglomeration effects for the HSR central scenario in this study ($3.4 billion) is almost 50 percent of the value of rail user benefits ($7.2 billion). Within academic literature, economic benefits from agglomeration are typically estimated to be in the region of 20 percent of direct user benefits on average (Graham 2018). However, across a range of studies, agglomeration benefits up to 56 percent have been identified (Oxera 2018). Therefore, the modelled estimates appear high relative to prior expectations, but within a plausible range.

To note, our agglomeration modelling (based on the Metrolinx methodology) forecasts significant economic benefits for all four of the zones. Our modelled agglomeration estimates for each zone are a function of the distance between zones (higher distance reduces agglomeration benefits due to the decay parameter), forecast uptake of CR/HSR services, and GDP. For example, Toronto’s agglomeration effect (as a percentage of GDP) is forecast to be one-third less than that of Montreal, due to be Toronto being slightly further away (from Ottawa, Montreal and Quebec City) than those cities are to each other. The agglomeration modelling is complex and sensitive to input assumptions, therefore it is important to recognize a degree of uncertainty around the precise value of agglomeration-related economic benefits.

Sensitivity Analysis

Ticket prices for CR/HSR impact the total benefits. For example, under the HSR central scenario, if HSR ticket prices were set 20 percent above existing Via Rail ticket prices, the forecast present value of user benefits falls by around 40 percent. The present value of economic benefits would fall by $4.2 billion compared to the HSR central case (from $20.7 billion to $16.5 billion), the majority being due to lower user benefits. However, recognizing cost of living concerns for Canadian households, it is also possible that median ticket prices could fall – such as through dynamic pricing – in which case economic benefits could also rise, by a similar amount.

The source of CR/HSR passengers will impact the estimated quantum of benefits, although relatively moderately. If proportions for “switchers” and “induced” passengers are sourced from VIA-HFR’s estimates, the level of economic benefits is $3.0 billion lower (falling from $20.7 billion to $17.7 billion). VIA-HFR’s forecasts assume a higher proportion of induced passengers, and also assume a greater share of switchers from air transport. As a result, the main impact of the VIA-HFR assumptions is to produce a smaller road decongestion effect, which reduces the potential benefits for road users.

The agglomeration calculation is relatively sensitive to the baseline assumption for passenger modal share. The modelling in this study is based on Canada-wide vehicle kilometre data, utilizing information from Transport Canada and Statistics Canada. Further analysis could be undertaken to refine this assumption across Ontario and Québec, while also ensuring that forecast agglomeration benefits align with wider estimates in existing transport literature.

Discussion and Qualifications

The analysis presented in this study is based on currently available information and projections, which are subject to certain limitations. Notably, there are uncertainties surrounding several key factors, including the precise routes and station locations, the design specifications (e.g., maximum achievable speed), ticket pricing, expected passenger numbers, the breakdown across ”switchers” and “induced” passengers, and passenger modal shares more generally. These elements, if altered, could impact the economic outcomes considerably.

There are several important qualifications to the scope of this study. First, it provides an analysis of potential economic benefits from CR/HSR investment but does not seek to quantify or analyze the direct costs involved in procurement, financing, construction, operations, maintenance or renewals. As such, this study constitutes an analysis of economic benefits, rather than a full cost-benefit analysis exercise. Second, this study seeks to estimate national, aggregate-level impacts, rather than undertaking a full distributional analysis of the impacts across and between different population groups. Third, this study’s primary focus is an economic assessment, rather than a transportation modelling exercise. The economic analysis utilizes and relies upon detailed, bottom-up passenger forecasts developed by VIA-HFR (received directly), cross-checked against the 2011 federal government’s previous HSR study. All three of these scope issues are important inputs to a holistic transport investment appraisal and should be considered in detail as part of investment decision-making.

Specifically, regarding this final issue – passenger forecasts – it is relevant to consider the transport modelling assumptions in further detail. As noted above, this study has not developed a full transport model, nor does it seek to take a definitive view on VIA-HFR’s forecasts. We would recommend that independent technical forecasts are developed. However, there are several relevant observations.

On one hand, VIA-HFR’s estimates do not appear implausible. For example, HSR has achieved a 7-8 percent share of passenger travel within certain routes in the United States (New York-to-Boston and New York-to-Washington), which would appear to be broadly consistent with the level of ambition within VIA-HFR’s passenger growth forecasts for the HSR central scenario (LEK 2019). The Madrid-Barcelona high speed link is estimated to serve 14 million passengers per year (International Railway Journal 2024). Internationally, HSR has achieved high market shares in Europe and Asia, such as 36 percent modal share for Madrid-Barcelona and 37 percent for London-Manchester, albeit noting that Europe typically has lower road usage and a higher propensity to use public transport (LEK 2019).

On the other hand, it is important to recognize the historic tendency for optimism bias within transportation investment projects. For example, in the UK, the HS2 project was criticized as having “overstated the forecast demand for passengers using HS2 [and] overstated the financial benefits that arise from that demand” (Written evidence to the Economic Affairs Committee, UK 2014). A review of HS2 in 2020 revised downwards previous estimates of economic benefits (Lord Berkeley Review 2020). As noted further above, analysis by the European Court of Arbiters (2018) posits that not all HSR projects induce sufficient passenger volumes to achieve net benefits over the project lifetime.

Overall, future passenger forecasts will depend upon a range of factors, including ticket prices, the availability and price of substitute modes (i.e., air), cultural preferences for private vehicle ownership, the impact of changing emission standards and the feasibility of construction plans.

This study applies some pragmatic, simplifying assumptions and approximations, applied to best practice transport appraisal (Metrolinx 2021; Department for Transport, UK, 2024). Across these modelling assumptions, there is variation in the directional impact on our estimates for economic benefits.

On one hand, some of the modelled benefits are likely to be relatively high-end estimates. First, for rail-user benefits, the modelling assumes no differential in ticket prices between existing VIA Rail services and CR/HSR. It also assumes that CR/HSR can deliver VIA-HFR’s proposed journey times with 95 percent reliability, which is achievable but not guaranteed. Second, for road congestion benefits, the forecast (direct) reductions in road congestion assume no indirect “bounce-back” effect where reduced traffic encourages new or longer trips (as noted above). For example, analysis of US highway demand suggests that capacity expansion only results in temporary congestion relief, for up to five years, before congestion returns to pre-existing levels (Hymel 2019). Third, for agglomeration, the modelled estimates for economic benefits are approximately 50 percent of rail-user benefits, which is close to the upper end of estimates from other transportation studies. Fourth, for emissions, the estimated benefits from forecast emissions savings do not seek to make assumptions about future changes to fuel efficiency for road and air transport, the emissions associated with power generation for CR/HSR, or the anticipated growth in electric vehicle adoption. In the case of electric vehicle deployment, there is uncertainty regarding the level of uptake, as well as the carbon intensity of electricity generation (albeit Ontario and Québec have relatively “clean” grids by international standards). Fifth, for benefits overall, this study leverages the VIA-HFR forecasts for passenger growth which are likely to be ambitious, though they have been robustly developed.

On the other hand, by focusing on the most material economic benefits, this study may exclude some smaller additional benefits that could be considered in further detail. First, there may be specific impacts on the tourism and hospitality sector. By enhancing travel convenience, CR/HSR is likely to draw more visitors to the various cultural, entertainment, and natural attractions across the corridor. As this influx would benefit local businesses by stimulating economic growth and job creation, these impacts are likely to be reflected within the estimate of agglomeration benefits.

Second, CR/HSR would improve national and global competitiveness, enhancing the appeal of Canadian cities to investors and environmentally conscious travellers while helping Canada align more closely with global standards for sustainable, modern infrastructure. Again, the economic benefits are likely to align with the agglomeration estimates.

Third, this study does not seek to quantify the potential gains to individual productivity from CR/HSR ridership, e.g., from individuals having time to work on the train. There is not expected to be a benefit for existing rail users, as they can already utilize Wi-Fi on existing VIA Rail services. For individuals switching to rail from road or air, potential benefits would only accrue to business users. Although switchers from road and air could have opportunities for improved individual productivity, Wi-Fi is increasingly available on airlines and individuals are able to dial into meetings remotely whilst driving.

Fourth, CR/HSR could generate wider economic benefits by increasing competition between businesses along the corridor. International transport appraisal literature suggests that enhanced transport connectivity can erode price markups (and therefore increase consumer surplus) by overcoming market imperfections (Metrolinx 2021; Department for Transport 2024). However, such impacts are likely to be relatively small, e.g., the Department for Transport (UK) estimates them at 10 percent of the benefits for rail business users only. Furthermore, sources of market power in Canada are legal in nature (e.g., interprovincial trade barriers) which rail investment alone is unlikely to overcome.

There are a further group of issues that have been excluded consciously from the methodology in this study. First, impacts on rail crowding are not considered. Some transport appraisals (such as the UK’s economic appraisal of the High Speed 2 project) do estimate the user benefits from reduced crowding. However, this is not as applicable for CR/HSR: In the UK, users of existing rail services may be required to stand if the train is overbooked, whereas users of existing VIA Rail services are guaranteed a seat with their booking. Second, impacts on land and property values are not included within the economic benefits. With greater access to efficient transportation, properties near rail stations typically see increased demand and value, boosting local tax revenues and promoting urban revitalization. While CR/HSR could increase values in areas close to the proposed stations, such changes are not additional to other wider economic benefits, but rather reflect a capitalization of those benefits. To avoid the risk of double counting the economic benefits already estimated, these are excluded (Department for Transport 2024).

CR/HSR may improve social equity and accessibility by offering affordable, reliable travel options for those without cars, including low-income individuals, students, and seniors. This expanded access enables broader employment, education, and healthcare opportunities, contributing to a more inclusive society. Whilst this study does not include a distribution analysis, social benefits from greater inclusion and social equity would constitute a benefit of CR/HSR investment and merit further detailed analysis.

Finally, in addition to policy considerations, major investment decisions have a substantial political dimension. For example, Canada is the only G7 country without HSR infrastructure. While cognizant of the political context, the analysis in this study is purely an economic assessment and does not consider political factors.

Conclusion

Canada’s population and economy continue to expand, particularly within the Toronto-Québec corridor. Existing transportation routes can expect greater congestion over time, particularly capacity-constrained VIA Rail services. In this context, can Canada afford not to progress with faster, more frequent rail services? There are significant opportunity costs to postponing investment.

This study has developed quantified estimates of the economic benefits of investing in the proposed Rapid Train project in the Toronto-Québec City corridor. Cumulatively, in present value terms, these economic benefits are estimated to be $11-$17 billion under our modelled conventional rail (CR) scenarios, and larger – at $15-$27 billion – under high-speed rail (HSR) scenarios. Economic benefits arise from several areas, including rail user time savings and improved reliability, reduced congestion on the road network, productivity gains through enhanced connectivity, and environmental benefits through emission reductions. With many commentators highlighting that Canada is experiencing a “productivity crisis” and a “climate emergency,” the projected productivity gains and lower-emission transportation capacity from the Rapid Train project present particularly valuable opportunities.

This study has assessed major economic benefit categories as identified within mainstream transport appraisal guidance. Further research could include additional sensitivity analysis around key parameters, as well as consideration of potential dynamic clustering effects, and projections for housing and land values.

Clearly, there is a cost to investment in a new dedicated passenger rail service: upfront capital investment, ongoing operations and maintenance expenditure, and any financing costs. These costs are not assessed in this study and will need to be considered carefully by policymakers. However, inaction – by continuing with the status quo rail infrastructure – also has a significant opportunity cost. Canada would forgo billions of dollars worth of economic advantage if it fails to deal with current challenges, including congestion on the rail and road networks, stifled productivity, and environmental concerns.

This study identifies the multi-billion-dollar economic benefits from the proposed Rapid Train project. While these benefits will need to be weighed alongside the forecast project costs, this study provides a basis for subsequent project evaluation and highlights the significant opportunity costs that Canada is incurring in the absence of investment.

Appendix

For the Silo, Tasnim Fariha, David Jones. The authors thank Daniel Schwanen, Ben Dachis, Glen Hodgson and anonymous reviewers for comments on an earlier draft. The authors retain responsibility for any errors and the views expressed.

References

Ahlfeldt, G., Feddersen, A., 2017. “From periphery to core: measuring agglomeration effects using high-speed rail.” Journal of Economic Geography.

Albalate, D., and Bel, G. 2012. “High‐Speed Rail: Lessons for Policy Makers from Experiences Abroad.” Public Administration Review 72(3): 336-349.

Amtrak. 2023. Amtrak fact sheet: Acela service.

Atkins, AECOM and Frontier Economics. 2014. First Interim Evaluation of the Impacts of High Speed 1, Final Report, Volume 1. Prepared for the Department of Transport, UK.

Blanquart, C., and Koning, M. 2017. “The local economic impacts of high-speed railways: theories and facts.” European Transport Research Review 9(2): 12-25.

Bonnafous, A. 1987. “The Regional Impact of the TGV.” Transportation 14(2): 127-137.

California High-Speed Rail Authority. 2022. “2022 Business Plan.” Sacramento: State of California.

Central Japan Railway Company. 2020. “Annual Environmental Report 2020.” Tokyo: JR Central.

Crescenzi, R., Di Cataldo, M., and Rodríguez‐Pose, A. 2021. “High‐speed rail and regional development.” Journal of Regional Science 61(2): 365-395.

Dachis, B., 2013. Cars, Congestion and Costs: A New Approach to Evaluating Government Infrastructure Investment. Commentary. Toronto: C.D. Howe Institute. July.

Dachis, B., 2015. Tackling Traffic: The Economic Cost of Congestion in Metro Vancouver. Commentary. Toronto: C.D. Howe Institute. March.

Department of Transport (Ireland). 2023. “Transport Appraisal Framework, Appraisal Guidelines for Capital Investments in Transport, Module 8 – Detailed Guidance on Appraisal Parameters.”

Department for Transport (UK). 2024. “National Road Traffic Survey, TRA0308: tra0308-traffic-distribution-by-time-of-day-and-selected-vehicle-type.ods (live.com).”

______________. 2024. “Road traffic estimates (TRA).”

______________. 2015. “Understanding and Valuing Impacts of Transport Investment.”

______________. 2024. Transport analysis guidance (various).

Economic Affairs Committee, UK government. 2014. Written evidence (Alan Andrews), “EHS0071 – Evidence on The Economic Case for HS2.”

European Court of Arbiters. 2018. “Special Report: A European high-speed rail network: not a reality but an ineffective patchwork.”

European Environment Agency. 2020. “Transport and Environment Report 2020: Train or Plane?” EEA Report No 19/2020.

Flyvbjerg, B. 2007. “Cost Overruns and Demand Shortfalls in Urban Rail and Other Infrastructure.” Transportation Planning and Technology 30(1): 9-30.

Garmendia, M., Ribalaygua, C., and Ureña, J. M. 2012. “High speed rail: Implication for cities.” Cities 29(S2), S26-S31.

Graham, D., 2018: “Quantifying wider economic benefits within transport appraisal.”

Government of Canada, House of Commons. 2019. Vote No. 1366. 42nd Parliament, 1st Session.

Government of Canada. 2023. “Social Cost of Greenhouse Gas Estimates – Interim Updated Guidance for the Government of Canada.”

High Speed Rail Authority (HS2 Ltd). 2024. “HS2 Phase One: London to Birmingham Development Report.”

Hymel, K. 2019. “If you build it, they will drive: Measuring induced demand for vehicle travel in urban areas.” Transport Policy Volume 76.

Indonesian-Chinese High-Speed Rail Consortium (KCIC). 2023. “Jakarta-Bandung High-Speed Railway Project Completion Report.”

International Railway Journal. 2024. “Spanish high-speed traffic up 37 percent in 2023.”

International Transport Forum-OECD. 2013. “High Speed Rail Performance in France: From Appraisal Methodologies to Ex-post Evaluation.”

International Union of Railways (UIC). 2022. “High-Speed Rail: World Implementation Report.” Paris: UIC Publications.

International Union of Railways (UIC). 2019. “Carbon Footprint of Railway Infrastructure.” Paris: UIC Publications.

Jacobs, J. 1969. The Economy of Cities. New York: Random House.

Kojima, Y., Matsunaga, T., and Yamaguchi, S. 2015. “Impact of High-Speed Rail on Regional Economic Productivity: Evidence from Japan.” Research Institute of Economy, Trade and Industry (RIETI) Discussion Paper Series 15-E-089.

Lawrence, M., Bullock, R. G., and Liu, Z. 2019. “China’s High-Speed Rail Development.” World Bank Publications.

LEK. 2019. New Routes to Profitability in High-Speed Rail.

Lord Berkeley Review. 2020. A Review of High Speed 2, Dissenting Report by Lord Tony Berkeley, House of Lords: Lord-Berkeley-HS2-Review-FINAL.pdf.

Marshall, A. 1920. Principles of Economics. London: Macmillan.

Metrolinx. 2018, GO Expansion Full Business Case.

________. 2021. Business Case Manual Volume 2: Guidance.

________. 2021, Traffic Impact Analysis Durham-Scarborough Bus Rapid Transit.

Morgan, M., Wadud, Z., Cairns, S. 2025, “Can rail reduce British aviation emissions?” Transportation Research Part D 138.

National High Speed Rail Corporation Limited (NHSRCL). 2023. “Mumbai-Ahmedabad High Speed Rail Project Status Report.”

Office National des Chemins de Fer (ONCF). 2022. “Al Boraq High-Speed Rail Service: Five Year Performance Review.”

OAS. 2019. “High Speed Rail vs Air: Eurostar at 25, The Story So Far.”

Oxera. 2018. “Deep impact: assessing wider economic impacts in transport appraisal.”

Reiter, V., Voltes-Dorta, A., Suau-Sanchez, P. 2022, “The substitution of short-haul flights with rail services in German air travel markets: A quantitative analysis.” Case Studies on Transport Policy.

Rete Ferroviaria Italiana (RFI). 2023. “Alta Velocità Network Expansion: Naples-Bari Route Completion Report.”

Rossa et al. 2024. “The valuation of delays in passenger rail using journey satisfaction data.” Elsevier, Part D (129).

Rungskunroch, P. 2022. “Benchmarking Operation Readiness of the High-Speed Rail (HSR) Network.”

Statistics Canada. 2023. Table 36-10-0468-01 Gross domestic product (GDP) at basic prices, by census metropolitan area (CMA) (x 1,000,000).

______________. 2024. Table 14-10-0420-01 Employment by occupation, economic regions, annual.

______________. 2024. Table 17-10-0057-01 Projected population, by projection scenario, age and gender, as of July 1 (x 1,000).

_____________. 2016. Table 8-1: Domestic Passenger Travel by Mode, Canada.

______________. 2014, Canadian vehicle survey: Canadian vehicle survey, passenger-kilometres, by type of vehicle, type of day and time of day, quarterly (statcan.gc.ca).

Transport Canada. 2021. Transportation in Canada 2020, Overview Report, Green Transportation.

_______________. 2018. RA16-Passenger and Passenger-Kms for VIA Rail Canada and Other Carriers.

Ministry of Transportation of Ontario & Transport Canada. 2011. “Updated feasibility study of a high-speed rail service in the Québec City – Windsor Corridor: Deliverable No. 13 – Final report.”