Royalties Are Bullshit: A Musician’s Case For Basic Income….. “This song is Copyrighted in U.S., under Seal of Copyright #154085, for a period of 28 years, and anybody caught singin’ it without our permission, will be mighty good friends of ourn, cause we don’t give a dern. Publish it. Write it. Sing it. Swing to it. Yodel it. We wrote it, that’s all we wanted to do.”

-Woody Guthrie, copyright notice, This Land Is Your Land

Royalties are bullshit.

I say this as a musician, and as a songwriter. But let me go a step further: royalties have always been bullshit. The first problem? They’re not going to musicians, and they never have.

If money is being made, something is being sold. That something has to be a product, something that can be counted. Originally it would have been sheet music, before recorded music was widely available. Later on, it meant records, then tapes, CDs, downloads, streams, as well as licensing rights – use in a specific film, or for a particular commercial. There is a product. Someone is buying it. Some of that money goes towards the cost of producing, distributing, and marketing that product; some of it goes to the artist, as royalties.

Well, a little bit of it goes to the artist.

As Billboard notes, “An accurate map of royalty pathways would be a tangled mess.” It’s not easy to get paid.

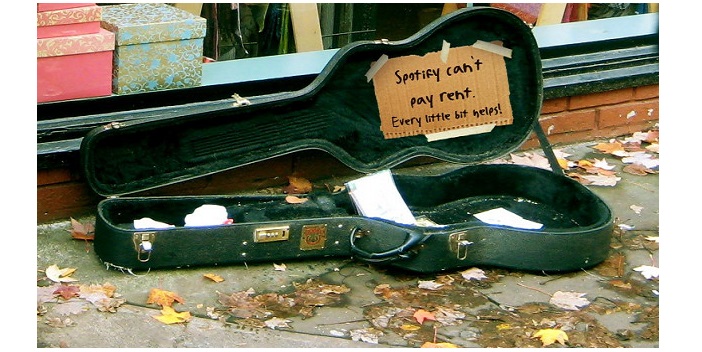

Some royalties are set by the government, some are negotiated, some are paid through groups. For example, I license my music through TuneCore, which strikes deals with a series of digital music outlets, like iTunes and Spotify, each of which offers different terms of payment. Spotify pays artists, on average, $0.007 cents per stream.

Beyond that, if you are “fortunate” enough to work with a major record label, there are restrictive terms and conditions. Techdirt quotes Tim Quirk of Too Much Joy explaining the Kafkaesque math [emphasis mine]:

A word here about that unrecouped balance, for those uninitiated in the complex mechanics of major label accounting. While our royalty statement shows Too Much Joy in the red with Warner Bros. (now by only $395,214.71 after that $62.47 digital windfall), this doesn’t mean Warner “lost” nearly $400,000 on the band. That’s how much they spent on us, and we don’t see any royalty checks until it’s paid back, but it doesn’t get paid back out of the full price of every album sold. It gets paid back out of the band’s share of every album sold, which is roughly 10% of the retail price. So, using round numbers to make the math as easy as possible to understand, let’s say Warner Bros. spent something like $450,000 total on TMJ. If Warner sold 15,000 copies of each of the three TMJ records they released at a wholesale price of $10 each, they would have earned back the $450,000. But if those records were retailing for $15, TMJ would have only paid back $67,500, and our statement would show an unrecouped balance of $382,500.

Of course, none of this is new, really. The history of artists getting screwed by record labels is as long as the history of record labels, and includes everything from the creative math above to outright theft, failure to count sales, or inventive stunts like Fantasy Records accusing John Fogerty of plagiarizing himself. But bear with me, because it gets worse.

In the music industry today, there are a few people who are making money from royalties- and they’re making nearly all of it. More specifically, the top one percent of earners are taking in 77% of the recorded music revenue. Strikingly, these are many of the same artists who are now “at war” with YouTube. Artists such as Taylor Swift and Paul McCartney are convinced that YouTube is making money from their music by selling ads and subscriptions, and not paying adequate royalties. And they’re not wrong; YouTube is definitely making money by selling ads and subscriptions, and there’s no question that most of that is not going to the artists.

However, this is a stupid argument.

It’s a stupid argument because a tiny group of people that’s making the lion’s share of all recorded musical income is concerned that a new service doesn’t adequately compensate them; the major record labels feel the same way, of course. It’s a “war” that leaves out 99% of the musicians out there trying to make music and make a living, and it doesn’t really matter how they settle the conflict.

So let’s say, hypothetically, that we eliminate royalties. This raises a fundamental question.

How do we compensate and credit artists for their work?

I believe the answer is basic income, but first let’s take a closer look at that question. At a glance, it seems like it should be simple: pay them for their music. But what does that mean? It quickly gets complicated.

Part of the problem is that we as a culture equate value with ownership. If musicians have created a song, this thinking goes, and that song has value, they must own it, like any other form of property. But that’s ridiculous, and it’s pretty easy to see how quickly it becomes truly absurd.

For example, take a classic blues song, like Big Mama Thornton’s “Hound Dog.” Is that her tune? Yes! Does she deserve credit for it? Absolutely. Big Mama Thornton has a special place in blues history, and rightly so. But is it the first example of a 12-bar blues? No, of course not. Is it the first time someone used lyrics about a dog? Is it the first time someone used the call-and-response verse structure of a repeated first line and different last line? No, and no. And even though she made it a hit, the lyrics were by Leiber and Stoller. So which part of the song does she “own”? Is it just that specific recording? If so, how much does the bass player own, or the drummer? Do you pay royalties for playing it on the radio? What if it’s on the radio, and you tape it? What if you give that tape to a friend? I know, I know, nobody tapes anything off the radio anymore. What if you cover it in a bar? What if you sing it in your living room? What if you sing it in your living room and upload it to YouTube? What if you share the MP3? Where do we draw the lines?

Woody Guthrie, speaking from the folk music tradition, said “New words, new song.” Bob Dylan took that lesson to heart, both in early works like “Masters of War,” which took a melody from an English folk song called “Nottamun Town,” and in more recent releases. On Modern Times he lifted lines from a Civil War era Confederate poet named Henry Timrod, and used the arrangement of Muddy Waters’ “Rollin’ and Tumblin'” with re-written lyrics and the same title.

I don’t mean to discount Big Mama Thornton, or disparage Bob Dylan. I’m a big fan of both. What I want to illustrate is that “property” and “ownership” is a meaningless way to look at music, because it’s a living, inherited tradition. Everybody got something from somebody. Every electric guitar player owes something to T-Bone Walker, and T-Bone owes something to Blind Lemon Jefferson. Every folk singer owes something to Woody Guthrie and Pete Seeger. And more to the point, if you ask any great musician, they will tell you who they got it from. Eric Clapton tells people about Buddy Guy, but if you put a microphone in front of Buddy he’s going to tell you about Muddy Waters, BB King, Guitar Slim. The greats are always ready to turn around and credit the people who came before them, because that’s how a living musical tradition works.

So again: how do we compensate and credit artists for their work?

Splitting the question

One answer is to split up the question. When you think about it, it’s really two different questions. Let’s look at the second part first: how do we acknowledge and appreciate and credit the work that artists do? This is especially important because many important contributions to music, art, and human history generally, were made by people who get erased from popular culture- in particular women, LGBTQ folks, and people of color (Ma Rainey, for example, was all three). They are erased, in part, because there is money to be made by erasing them.

The uninformed still think “Hound Dog” and “That’s All Right” are Elvis Presley tunes. And while Presley himself was quick to credit his influences, most people have never heard of Arthur Crudup, and everyone’s heard of Elvis. Sometimes people were erased several times over; early blues music was driven by women like Bessie Smith, Ma Rainey, and Sister Rosetta Tharpe, who were largely displaced by black men, who then had their music co-opted by white guys playing rock’n’roll versions of the same songs. Some made serious efforts to show people where the music had its roots – The Rolling Stones, appearing on the show Shindig in 1965, insisted that Howlin’ Wolf also get to perform. On the other hand, Led Zeppelin took Willie Dixon’s song “You Need Love,” and recorded it as “Whole Lotta Love,” without ever mentioning where they got it. It’s ironic, since Dixon himself was notorious for taking credit and royalties for other people’s work, often by offering to “take care of the paperwork” on a new tune.

So how do we make sure we credit and acknowledge artists? One way, I believe, is to end a system of compensation based on owning something that cannot be owned. In a system like we have now, where the focus is on ownership of a particular sound, or song, or style, there is a real financial incentive to take credit. In the case of the record labels, you can even get the actual rights to an artist’s songs. If we disconnect the money from the “ownership” of the music, we are removing part of the incentive to pretend that new music doesn’t freely flow from old music.

Universal Basic Income

To be clear, I’m not suggesting artists should not be paid. There are different ways to support artists, and the internet has allowed for a lot of direct interaction between artists and fans. There are crowdfunding sites like Kickstarter and Patreon, there are independent music platforms like BandCamp and CDBaby. They’ve got their advantages and disadvantages, but what I’m advocating is something simpler, more widespread and direct: universal basic income.

Universal basic income, sometimes called emancipatory basic income or simply “basic income,” is an easy idea to understand: you give everybody money. Everybody. Rich people, poor people, working people, the unemployed, the young, the old, everybody. Everybody gets a salary. It’s not a lucrative salary, but enough to make sure you can provide for yourself.

First, let me clear something up: this is not a wild, crazy, utopian idea. It’s a serious proposal, that is increasingly being treated as such. Even Forbes ran a piece called “Universal Basic Income Is Not Crazy.” Of course, it works better if you already have some of the social framework much of the world takes for granted: child care, family leave, health care. But let’s leave those aside for a moment to look at basic income from the musician’s perspective. What is the impact for working musicians?

Quit Your Day Job

Many, if not most, working musicians [and artists CP] support themselves with a day job. This includes long-time performers with steady gigs, people who have gone on world tours and recorded on dozens of albums. Buddy Guy drove a tow truck into his thirties. Composer Philip Glass worked as a plumber and taxi driver until he was 41. Wes Montgomery worked in a factory from 7am to 3pm and played gigs until 2am.

Let me tell you: it’s not easy. As a musician, you already have to balance many competing demands: playing gigs, traveling, booking and promoting shows, recording new material, rehearsing a band. Being a professional musician is, effectively, more than one job already. Now try to schedule all that around a conventional job structure that wants you working at 8 or 9 in the morning, 5 days a week, regardless of where you played last night or when you got home. It’s hard to fit all of it in, and that’s without stopping to consider that it might be nice to sleep occasionally or even see your family now and then.

One reason basic income is sometimes called “emancipatory” is because it frees you from this burden. You’re still going to be out there hustling for gigs, scheduling sessions, trying to record and promote and – let’s be real – get paid. Basic income doesn’t eliminate the desire or possibility for people to make money by working, it just means you don’t have to worry about starving or getting evicted while you do it. And let’s remember, most of the money musicians make doesn’t come from royalties anyway. People are getting paid for gigs, for shows, for studio sessions, for tours, sometimes for merchandise or direct sales (in particular if you’re producing your stuff independently).

Make The Music You Want To Make

Musicians make compromises all the time. Sometimes it’s about timing: you want to put something out, and you can’t afford to wait, so you settle- you keep a take that could have been better, you scratch a song that needs a few more sessions to come together. Sometimes it’s about the sound: a record label wants to market you a particular way, a track needs to be “radio friendly” to get airplay. Sometimes it’s just about resources: recording and producing music, even with all the advances in digital technology, is a laborious, expensive process. For some players, there’s also the trade-off between taking gigs that might pay better but be musically unfulfilling (think wedding band or corporate events) versus pursuing a musical vision that might not have a ready-made market. And, of course, there’s that most precious of all resources, time, which is often given over in huge amounts to the aforementioned day job.

Basic income removes the immediacy of financial pressures, and frees up a lot of time. Does that mean we won’t have choices to make? No, of course not. There are always choices, and there are always constraints, and even if we get basic income that won’t turn time itself into a limitless resource. But it changes the balance of the decision.

Creative Liberation: Supported By Research

Right now, across the country, there are brilliant artists whose music could change and enrich our culture in ways we can’t imagine, and we don’t get to hear them. They’re stuck working day jobs, playing the gigs that pay the bills, and trying to fit their creativity into commercial constraints. Pause for a moment, and imagine the explosion of new sounds and ideas we can liberate with basic income.

As a musician, that paragraph felt intuitively true to me. However, a number of people who were kind enough to review an early draft of this essay suggested that my point might be better served if I backed it up with “evidence” and “examples.” Of course, there’s not exactly a one-to-one comparison available, so I’m going to draw on some similar programs and related ideas.

First: the MacArthur “Genius” grants. These fellowships are awarded to people who are already recognized to be exceptional; they provide a no-strings-attached stipend of USD$625,000 over five years. Obviously that’s a lot more than “basic” income, but they underpin the idea that simply providing creative people with resources allows them greater freedom to explore, discover, and create. In a review of their program and its effectiveness, The MacArthur Foundation found that 93% of the fellows reported greater financial stability (no surprise) and 88% reported an increased opportunity to express creativity. Three quarters felt it lead them to make riskier, more ambitious choices in their work.

Some might argue that the fellowships exhibit a selection bias, since they go to people already known to be creative. However, there’s good reason to believe that supporting the poorest and most marginalized offers even greater benefits. Dissent magazine recounts the history of the Federal Writers Project, which offered “unemployed” writers guaranteed income by giving a fixed salary to produce travelogues or other commissioned writings:

…with regular paychecks, FWP writers could experiment with more creative projects at the same time. Over the course of eight years, the program employed over 6,600 writers, including Nelson Algren, Jack Conroy, Zora Neale Hurston, Richard Wright, and Ralph Ellison. The FWP enabled new classes of Americans to become “professional” writers.

While employed by the FWP, these writers—most notably writers of color—wrote fiction that challenged the political status quo, and they revolutionized literary form in order to do so. To be sure, many of these writers developed their politics in pre-FWP years, but stable employment facilitated their political and artistic ambitions—by providing them with steady income, connecting them to other writers, and offering literary inspiration. From 1936–37, between posts at the Federal Theatre Project and the FWP, Hurston wrote her beautiful and troubling novel Their Eyes Were Watching God, a book celebrated today for its inventive use of black vernacular. Wright spearheaded the “Chicago Renaissance,” a creative community strengthened and supported by FWP projects in the state of Illinois. Meanwhile, in New York City, Ellison was conducting FWP oral histories when, as he reported it, he stumbled across a man who described himself as “invisible.” This encounter would be the genesis for his Invisible Man, surely one of the strangest and most significant novels of the twentieth century.

I recognize that the subjective self-evaluation of MacArthur fellows and even the impressive work of FWP authors can be considered, to some extent, anecdotal evidence. But there is also controlled research, and what it shows is the flip side of the coin: that poverty impedes cognitive function. Lead by Harvard economist Sendhil Mullainathan, the team found that “experimentally induced thoughts about finances reduced cognitive performance among poor but not in well-off participants.” They also found that farmers showed diminished cognitive ability before harvest, when they were poor, compared to after harvest when they were relatively rich. That’s after controlling for free time, nutrition, work effort, and stress.

If you’ve ever been broke and had bills to pay, this is not news. It’s hard to focus when you have a huge bill hanging over your head and no immediate prospect for paying it off. When you’re in a position of financial hardship, a portion of your brain is effectively set aside to repeating over and over again, “AAAH THE RENT AAAH THE RENT AAAH THE RENT.” Or the hospital bill, or the car payment, etc. You know the classic sci-fi trope that imagines what you could do if you could harness the full power of your brain? Turns out it doesn’t require genetic engineering – you just need to be able to pay your bills.

I would argue that we are effectively paying a cultural opportunity cost in the form of lost creativity. Coming back to music, anthropologist David Graeber puts it this way:

“Back in the 20th century, every decade or so, England would create an incredible musical movement that would take over the world. Why is it not happening anymore? Well, all these bands were living on welfare! Take a bunch of working class kids, give them enough money for them to hang around and play together, and you get the Beatles. Where is the next John Lennon? Probably packing boxes in a supermarket somewhere.”

The Robot Imperative – It’s Not Just About Musicians

I realize we’re covering a lot of ground here, and we’re about to talk about robots. So first, a quick recap

Royalties don’t go to (most) musicians.

Royalties don’t make sense because they rely on ownership of something that cannot be meaningfully owned.

This system of ownership creates financial incentives to take credit for other people’s work.

Eliminating royalties forces us to confront the fundamental question of how we credit and compensate artists for their work.

Basic income answers part of that question – compensation – while eliminating royalties removes, at least in part, the financial incentive to take credit.

Basic income liberates musicians from the constraints of a day job and the pressures of commercial music.

Evidence supports the idea that this liberation leads to more, and more adventurous, creative work.

In short, basic income separates the idea that people have value from the idea that they must own something valuable.

All of that has been true for quite some time, and in fact arguments for basic income are as old as Thomas Paine. But there is a huge, disruptive change happening that makes this a much more urgent question, not just for musicians but for everyone. Namely, robots. Robots and computer automation are about to eliminate huge numbers of jobs (think tens of millions). Some are in the news right now: Uber is testing self-driving cars in Pittsburgh. Driverless trucking is not far behind, taking 3.5 million jobs with it. And it’s not just truckers: designers, fast food workers, accountants, financial analysts, doctors, hotel concierges. Thousands of news stories are being written by robots. An Oxford University study estimates that 47% of total employment may be at risk. Even jazz musicians have to be worried.

In short, the day job could be going away, and not just for musicians. The question is, what will we do with these millions of people, once they’re out of work? Will we insist that truckers can all get jobs doing social media? Will a few wealthy people retreat behind high walls and leave the rest of us to fight for the scraps of employment through a fog of financial worry and expensive, short term trade-offs?

Or will we embrace basic income, recognize that people have innate value, and unleash a wild torrent of creative exploration the likes of which we’ve never heard before? For the Silo, Anthony Moser. www.anthonymoser.com

@mosermusic

Royalties and copyright:

The Music Industry is a Parasite And Copyright Is Dead by Steve Albini

Free Culture by Lawrence Lessig

PS – My music is available on iTunes, Spotify, YouTube, Bandcamp, and a host of other digital music services. If you catch me at a gig, you can buy an album for name-your-price. And if anyone ever uploads it to The Pirate Bay, torrent with my blessing. As Woody Guthrie would say, “Publish it. Write it. Sing it. Swing to it. Yodel it. We wrote it, that’s all we wanted to do.”