This feature via our friends at toptenrealestatedeals.com

Black Sam Bellamy was one of the most notorious and wealthiest pirates of the Golden Age of Piracy in the early nineteenth century. In his short pirate career, he captured fifty-three ships, including the English slave ship Whydah Gally, which he used as his flagship.

The famous pirate’s island hideaway, now a stunning resort property, has been listed for sale at $50 million usd. Black’s Island is a seven-acre gem off the coast of the Florida Panhandle, sporting a four-star resort with twenty-six waterfront bungalows. Accessible only by boat, seaplane or helicopter, the white-sand island is about ten minutes from the mainland, offering a spectacular Caribbean adventure without leaving the United States.

The property can be operated commercially or retained as a family compound.

Born in Devon, England, he sailed with the Royal Navy before joining a crew of treasure hunters who turned to piracy when their mission to find a Spanish shipwreck failed. Bellamy served initially under Captain Benjamin Hornigold and his first mate, Edward Teach, later known as Blackbeard. When the crew became frustrated with Hornigold’s refusal to attack English ships, they mutinied and elected Bellamy as their captain instead. He was generous with those he raided and loved by his crew, who called themselves “Robin Hood’s Men.” This “Robin Hood of the Sea” or “Prince of Pirates” developed a distinctive style, favoring long black coats and forgoing the then-fashionable powdered wig for a dark ponytail tied with a black satin bow.

His favorite weapons were four dueling pistols carried in his sash.

The pirate prince’s reign ended when a nor’easter storm capsized his ships, drowning the captain and most of his crew. The wreckage of the Whydah Gally was discovered in 1982, yielding over 200,000 artifacts, including a cannon loaded with gold and precious stones.

1982 discovery of Black Sam’s booty made headlines worldwide. image: Irish Sun

The fully furnished bungalows come in one- and two-story models, 1,225 and 1,425 square feet respectively. Each unit includes two bedrooms, a loft bedroom area, two full bathrooms, a spacious kitchen with an island and top-notch appliances, a living room, a dining area, a laundry room and a balcony, while the two-story bungalows have an additional half bathroom. Boasting a classic look with blonde wood walls and grey stone floors, the bungalows were recently remodeled. A round floorplan offers 360-degree views of the gorgeous island from sunrise to sunset.

In addition to the bungalows, the resort includes a four-story luxury clubhouse, a cabana with bar, beach volleyball courts, and a forty-by-sixteen-foot swimming pool. The island is in the middle of a marine estuary, offering sparkling clear water and numerous opportunities for bird-watching and duck hunting, plus kayaking, paddle boarding, jet skiing and relaxing on the beach.

Private islands are all the rage among celebrities and the world’s elite. Beyonce and Jay Z are said to own two private islands in Florida, with Leonardo DiCaprio, Eddie Murphy, David Copperfield, and Mel Gibson just a few of the A-listers with private islands outside the USA.

The listing is held by Jon Kohler of Jon Kohler & Associates. Photo credit: Jon Kohler & Associates.

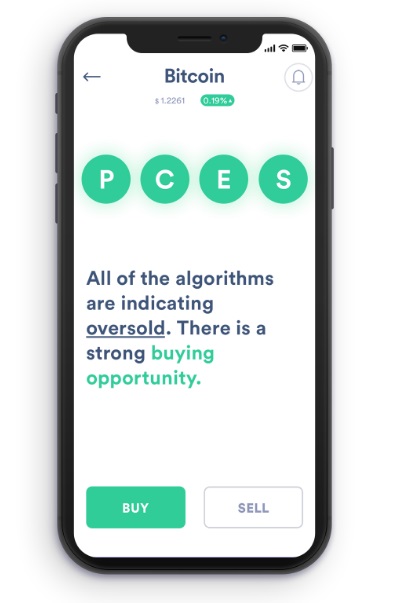

“White Shark is a game changer.” White Shark app enthusiast Ryan Kesler of the Anaheim Ducks explains. “It’s so easy and fun to use. Buying and selling crypto has become part of my daily routine. There’s no guess work in making money – the accuracy of the algo trading is the only way to go.”

“White Shark is a game changer.” White Shark app enthusiast Ryan Kesler of the Anaheim Ducks explains. “It’s so easy and fun to use. Buying and selling crypto has become part of my daily routine. There’s no guess work in making money – the accuracy of the algo trading is the only way to go.”

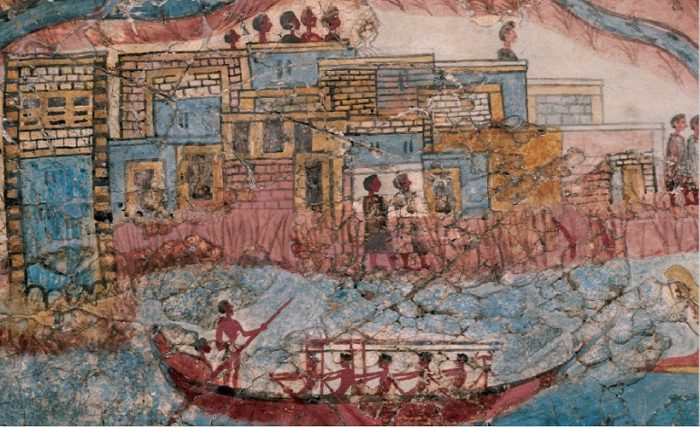

Trade networks, however, were not durable. The contributors discuss the establishment and decline of great trading network systems, and how they related to the expansion of civilization, and to different forms of social and economic exploitation. Case studies focus on local conditions as well as global networks until sixteenth century when the whole globe was finally connected by trade.

Trade networks, however, were not durable. The contributors discuss the establishment and decline of great trading network systems, and how they related to the expansion of civilization, and to different forms of social and economic exploitation. Case studies focus on local conditions as well as global networks until sixteenth century when the whole globe was finally connected by trade.