These 5 Hot-Rodders Forged the Legacy of the Flathead

The impact of Ford’s flathead V-8 on the hot rod scene is undeniable. But the individuals that immortalized this engine—and, along the way, laid the foundation for the hot-rod scene—are the real heroes.

photo- Brandan Gillogly

n the early 1900s, horsepower was almost exclusively for the Gatsbys of the world. Ford’s flathead V-8, introduced in the depths of the depths of the Great Depression, changed all that. But it needed some help from car obsessives, who went on to invent what we now know as hot-rodding. Learn about them below, then check out Preston Lerner’s deep dive on the Flathead and its impact here.—Ed.

While it’s not without its flaws, the Ford flathead V-8 marked a significant milestone in the history of American performance. Ford’s mass production of the flathead opened up racing to a whole new audience and helped an industry flourish. Ford wasn’t alone, however, as the factory-built flathead was just a building block. Several individuals, through their own innovation and business acumen, were able to build flathead V-8s to horsepower levels that pushed boundaries of speed, developed a massive segment of our hobby, and forged long-lasting businesses, many of which are still with us today. Here are five pioneers of the aftermarket that used the flathead V-8 to cement themselves and their companies in American culture.

Ed Winfield

1901-1982

Known as “The Father of Hot-Rodding,” Winfield got his first job in a blacksmith shop when he was just eight. By the time he was 11, he was stripping down the neighbor’s Model T to shed weight and make it faster. Two years later, he was working on carburetors in Harry A. Miller’s Los Angeles shop where Barney Oldfield’s groundbreaking Golden Submarine race car was being built. With a knack for machinery and an intimate knowledge of engines, Winfield started his own carburetor company in 1919 and began grinding cams the following year. His carburetors were used on eight of the ten Indy 500 winners from 1933-1946, the only exception was Wilbur Shaw, who had won with a Winfield-fed Shaw/Offenhauser engine in 1937 and switched to Maserati power for his wins in 1939 and 1940.

Winfield did it all, from serving as a riding mechanic and racing at Ascot Speedway to working with major automakers in developing engines. Winfield also helped a young Ed Iskendarian with cylinder head work. He was inducted into the Indianapolis Motor Speedway Hall of Fame in 1983 and the Motorsports Hall of Fame in 2011.

Vic Edelbrock Sr.

1913-1962

Already an established mechanic, Vic Edelbrock Sr. designed the Slingshot intake manifold for flathead Ford V-8s in 1938 and tested it on his own 1932 Ford roadster on Southern California’s dry lakes. After WWII, Vic moved into a new shop in Holywood and designed his first cast aluminum cylinder head for flathead V-8s. Also in 1946, Edelbrock created its first catalog of speed parts, and soon its products were found on cars competing in virtually every form of racing, whether it was on the 1/4-mile, on circle tracks, or America’s dry lakes. His son, Vic Jr., took over the business after his passing and expanded the business to include fuel injection and superchargers. Vic Jr. passed away in 2017, but the company continues to make performance parts. To this day, the company makes Victor and Victor Jr. cylinder heads and intake manifolds that keep their legacy alive.

Stu Hilborn

1917-2013

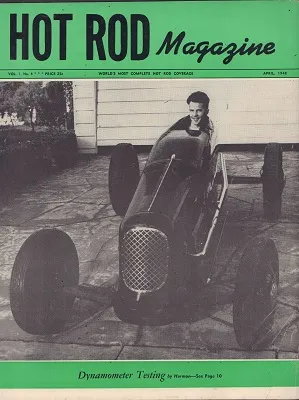

Born in Canada, Hilborn came to southern California in time to graduate high school and attend junior college in Los Angeles before enlisting in the Army Air Corps (you’re going to notice a trend here). While working on aircraft, Hilborn began scheming up a new way to feed fuel to engines, and once he was back in Southern California, he built a dry lakes racer that would prove his constant-flow fuel injection could compete and win against carburetors. The sleek racer was the first to eclipse 150 mph on the dry lakes and graced the fourth cover of Hot Rod magazine in April, 1948.

Hilborn continued to modify and improve his fuel injection design, and in 1952 Bill Vukovich drove the Fuel Injection Special in the Indy 500, where he led 150 laps and was just nine laps from the finish when a steering issue sidelined the car. That was tough luck for Vukovich, but 22-year-old Troy Ruttman passed him and took the win. Rutman, like Vukovich, was running Hilborn fuel injection, as were the remaining drivers on the podium. You can think of Hilborn’s mechanical fuel injection taking over for Winfield’s carburetors, as the individual throttle body system became the induction of choice for America’s top racers, dominating the Indy 500 for decades, claiming 34 victories along the way. Hilborn stacks appeared on road racers of all kinds, and the company’s two-port units could be found atop supercharged drag cars as well, but it all started with the dry lakes flathead.

Alex Xydias

1922-2024

Alex Xydias passed away earlier this year at the age of 102, leaving behind an impressive legacy of business achievement and generosity. His name is synonymous with the So-Cal Speed Shop, the Burbank speed equipment emporium he founded after leaving the Army Air Corps in 1946. The most famous product of that enterprise is the iconic belly tank lakester that graced the January 1949 cover of Hot Rod magazine after it ran using Ford V-8-60 power. The So-Cal Speed Shop followed on the success of the lakester with a sleek streamliner that would go on to be powered by a Mercury flathead that would push the car to 210.8962mph, the fastest time of Speed Week 1950, earning Xydias back-to-back spots on the coveted Hot Rod trophy, and the first in excess of 200mph.

Xydias forged relationships with speed parts manufacturers and helped get race-winning parts into the hands of southern California hot-rodders through his shop, but So-Cal Speed Shop also sold parts across the country through its mail-order catalog, using the fame of his racing success to get more enthusiasts involved by proving what the flathead was capable of.

Ed Iskenderian

1921-

Ever a hot-rodder, Ed Iskenderian’s T roadster was and continues to be an influential build, but there’s a reason he’s known as the Camfather. Shortly after returning from United States Army Air Corps service during WWII, Iskendarian was eager to return to building engines, particularly flatheads, but the booming demand vastly exceeded supply. He didn’t waste time waiting for other cam grinders to catch up. Instead, Isky, already experienced with tool and die work, purchased a machine and converted it to grind cams. Not only were his camshafts effective, but Isky was a talented marketer, coining the term “5-Cycle Cam” to describe his camshafts that used valve overlap and the escaping exhaust gases to scavenge the incoming intake charge. In addition to his many pioneering valvetrain advancements, Isky is also credited with selling logo t-shirts before anyone else.

Iskendarian cams are still used by some of the quickest and fastest racers today.

Featured image via –Historic Vehicle Association For the Silo, Fabian Hoberg / Hagerty.