When selling a house, one of the most challenging decisions is determining whether to accept the first offer and move on or wait for a better one to come along. According to Denis Smykalov, founder and broker of Wolsen Real Estate, there are several factors to consider when deciding whether to accept the first offer.

Mr. Smykalov believes that the quality of the offer goes beyond the price tag.

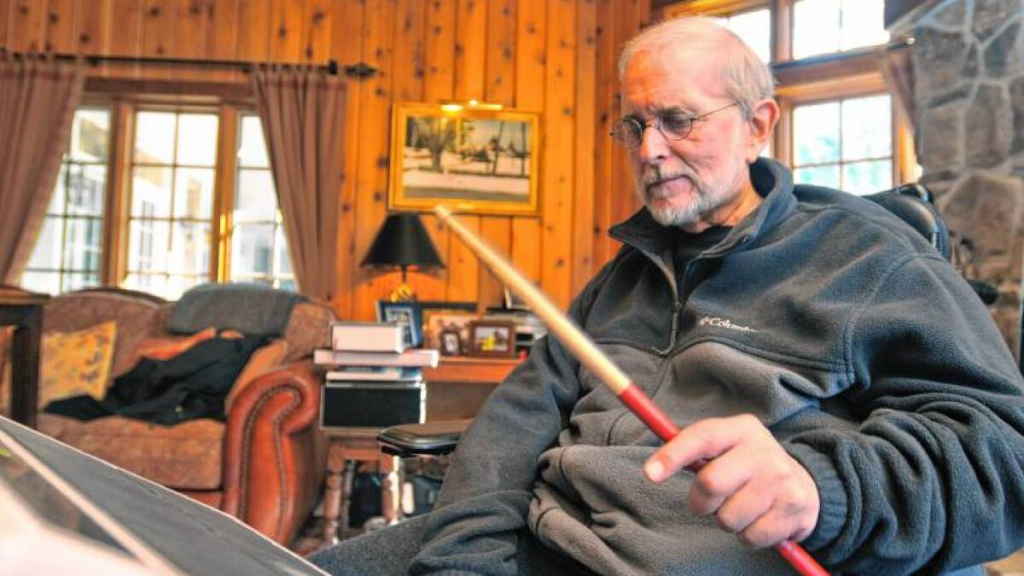

Denis Smykalov

A strong offer could entail fewer contingencies or a flexible closing date. If a buyer is pre-approved for a mortgage and is not asking for many contingencies, it may be in the seller’s best interest to accept the initial offer.

The current real estate market can also play a significant role in deciding whether to accept the first offer. It may be wise to accept a reasonable offer in a buyer’s market to avoid the property staying on the market for an extended period. On the other hand, in a seller’s market, where demand outpaces supply, sellers may receive offers that meet or exceed the asking price. If the buyer has strong financing, it could be a good idea to accept the first offer.

Speed is also a significant factor in determining whether to accept a first offer.

If the seller needs to move quickly or has already purchased another home, accepting the first offer might be the best option. In these cases, a bird in the hand is often worth two in the bush.

Feedback from a real estate agent is also essential in making a decision. A good agent understands the market and can advise whether the initial offer is competitive based on the current conditions.

Lastly, if the seller believes they have priced their home correctly and the first offer aligns with their expectations, it may be a good idea to accept it. Ultimately, only the seller can determine what offer price they are comfortable with. If the first offer meets that threshold, it could be a good time to make a deal.

It is essential to remember that each selling situation is unique, and these guidelines only provide a starting point. Sellers should always consult a real estate professional who understands their specific situation and the local market conditions.

In conclusion, accepting the first offer is a decision that requires careful consideration.

Denis Smykalov’s insights provide valuable guidance in determining whether the initial offer is the best option. With extensive experience in the industry, Mr. Smykalov’s expertise can help sellers make informed decisions when it comes to selling their home. For the Silo, Katherine Fleischman.

More about Denis:

Denis Smykalov built his career in the real estate industry over the last nine years by following his passion for being innovative, people and bringing the two together in the ideal environment. Achieving this goal so young, Smykalov decided to open an office in Sunny Isles Beach and became the owner of Wolsen Real Estate.

With business on the rise, at one point there were 65 agents. Now there are 25 agents, a marketing department, social media department sales department and 3 assistants that have successfully helped bring in almost 80 million dollars in sales this year. His most notable accomplishments with Wolsen Real Estate were two crypto transactions. One was a resale at Marina Blue for $465,000, pre-construction at Waldorf Astoria for over $2.5 million as well as a villa sale on Hibiscus Island for $19 million.

“It made me realize how much hunger there is for information on how divorces work,” said Alexander. “No one ever expects to get a divorce, so it’s not a subject that people spend much time learning about until they are facing one. It can be hard to catch up at such a stressful time.”

“It made me realize how much hunger there is for information on how divorces work,” said Alexander. “No one ever expects to get a divorce, so it’s not a subject that people spend much time learning about until they are facing one. It can be hard to catch up at such a stressful time.”