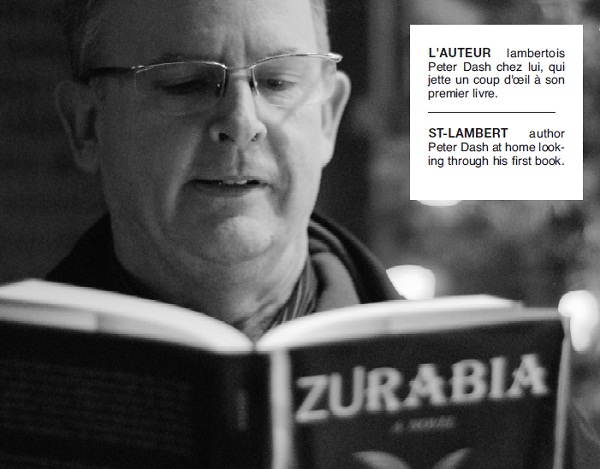

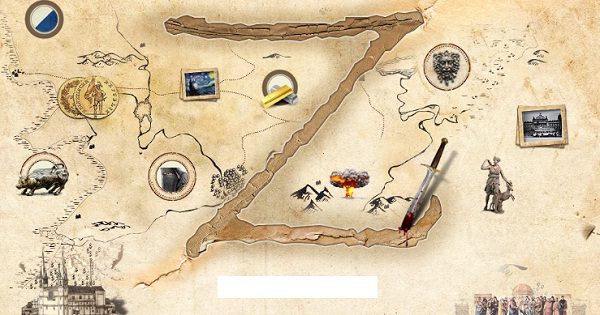

Back in 2012 The Silo reported on a dark novel titled Zurabia. That book held a plot that seems less like fiction with each passing year. Corrupt bankers, a practically valueless dollar, hyper-unemployment and underemployment, home-grown terrorism, the uptick in natural disasters and the overall lack of trust in our most important institutions – these are some of the reasons all North Americans should be very, very concerned, according to author Peter Dash a world-traveled researcher for Harvard University’s Center for International Affairs.

“I predict a brutal world ahead of us,” says Dash, author of “ZUrabia,” a book about rogue forces taking over the world’s most important institutions. “Unfortunately, I have been right since my research at Harvard in 1986, when I questioned the viability of government institutions to meet general needs and growing problems, both domestically and abroad.”

The pragmatic holiday shopper this year will purchase items to safeguard their families against these threats, which have been long in the making and won’t disappear quickly, he says.

“Terrorism wasn’t inaugurated with 9-11; extremism in Muslim sects has been growing for decades, and Neo-Nazi groups are starting to flourish in failing states like Greece,” he says. “The dollar has been steadily losing its value since the creation of the Federal Reserve in 1913; climate change has been on the radar for quite a while; and there have been greedy bankers since, well, banks have existed.”

“If you’re confident that everything is sure to be okay, then you’re not paying attention,” he says.

He offers a four-point survival strategy for holiday and everyday shopping:

• Gold is good: The dollar has lost 95 percent of its value in 100 years, and it will continue losing value. As

the Reserve continues to flood money into the system, thereby reducing current or potential value, more inflation is inevitable, acting as yet another tax on wages. So, collect and buy any gold that you can and consider spending federal notes while they’re still worth something to businesses. Think about your

jewelry, and buying more. Silver is a good option if gold is too expensive, and there are Exchange Traded Funds, or ETFs, that are backed by physical gold. A reputable banker or broker can help explain for those who are interested. “TD Ameritrade or Charles Schwab may be good places to start getting information on gold and silver ETF trading,” according to Dash.

• Inflation: Spend your money now or smartly invest it before you lose it. Remember, banks often give clients less than one percent on many accounts, but inflation on food and real items we use, like gasoline, are going up by much more. In essence, your banker is stealing your money through the assistance of the Fed, which is killing your savings rate by cheapening money. As if to pour salt on this wound, the bank,

in many cases, lends money at four percent or higher. Rerouting some bank savings/wages by investing in canned food, for example, may protect you against the scourge of food inflation, as well as other disasters.

• Worthy purchases: With food and water, a failed society puts a premium on additional goods. They include home insulation, gardening tools and materials, computer programs and language learning kits – perhaps Spanish or Chinese – because of the increasing prominence of other cultures. Guns, security systems and other measures to protect one’s home will likely prove extremely valuable should law enforcement be spread too thin, or fail as an institution.

• Buy in bulk: Places like Wal-Mart or Costco will help you get the most value with large purchases of food. It’s important to be well-stocked if something happens that results in the emptying of grocery markets, but remember to have adequate space in your house, apartment or cabin for a “safe” room, which is part of a sound strategy for protecting you and your family.

Peter Dash has been a teacher, professor and corporate trainer for the last 17 years, working in Saudi Arabia, the former Soviet Union and China. He has an applied science degree in forestry from the University of British Columbia and a Masters in applied teaching from Southern Queensland in Australia. He was a researcher in world (dis) order and youth groups at Harvard University’s Center for International Affairs, started by Henry Kissinger. He follows the investment field intensely, focusing on commodity funds and trends.

Fifteen percent of his book’s royalties will go to needy students consistent to the many years Dash has worked in assisting voluntary youth organizations. He lives on a small tropical island that is stocked with the finest well water, fish and food. Dash invests in Gold ETFs and commodity trading companies.

Supplemental– CBC radio interview with Dash on Zurabia