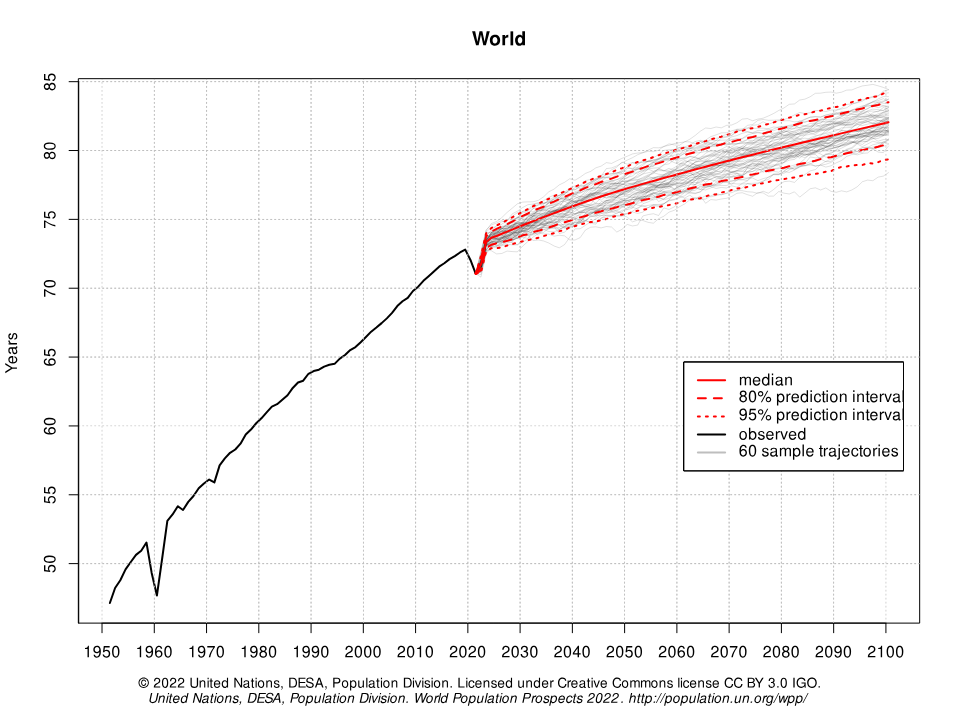

- Due to longer lifespans, governments and employers must reshape approaches to retirement to ensure ageing populations can live fulfilling, healthy lives

- New survey indicates shifting views on retirement and stark differences in how younger and older people see their future

- World Economic Forum report provides new approaches to retirement that governments, employers and individuals can consider

New York, USA, June 2023 – Life expectancy increased from an average of 46 to 73 years between 1950 and 2019 and the United Nations forecasts further increases, estimating that global average life expectancy will reach about 81 years by 2100. Longer lifespans are causing individuals, governments and business leaders to rethink their approach to work and retirement.

Living Longer, Better: Understanding Longevity Literacy, a new World Economic Forum report, in collaboration with Mercer, a business of Marsh McLennan, explores how lengthening lifespans are reshaping how individuals view their working lives and retirement. The report offers recommendations for government and employers to ensure they are adequately supporting people in multiple stages of work and retirement.

The report highlights purpose and quality of life in addition to financial health and resilience – themes that are traditionally associated with retirement planning. It offers options that individuals can consider to ensure they are approaching work, learning and retirement in ways that best meet their needs.

“When it comes to longevity and living longer, healthier lives, everyone has a role on this critical topic,” said Haleh Nazeri, Longevity Lead, World Economic Forum. “How will business support an older workforce and one with growing caregiving needs, what will policymakers do to help all citizens reach retirement equity, and finally, what can individuals do at every life stage to ensure they are able to stay financially resilient in a longer life.”

“Employers are thinking more about the current age distributions within the areas of talent needed to operate their organizations and how to influence the trajectory of these distributions,” said Rich Nuzum, Executive Director, Investments & Global Chief Investment Strategist, Mercer. “To leverage longevity and fight the war for talent effectively, moving from individual roles to team-based roles can help employers take full advantage of the diverse strengths of teams that comprise a combination of older and younger workers.”

Views on Retirement

A new survey, Pulse Poll, of almost 400 professionals indicates that women and men view retirement differently. Women, for example, are 55% more likely to say they don’t know if they have saved enough for retirement.

The poll also reveals differences in how younger and older populations view their retirement futures. Both women and those under 40 are more willing to reskill but worry about associated costs. Both groups are also more likely to feel isolated.

Further results from the Pulse Poll can be found below and in the report:

- Health is a top concern with two thirds of respondents indicating they expect to have caring responsibilities

- Days of “Bank of Mum and Dad” may be reversing; many younger people are likely to have to financially support older family members

- Pulse Poll respondents over 40 target lower income replacement levels in retirement

- People are generally unaware of how to achieve their target levels of retirement income

- More men looking forward to retirement, while more women need to understand their financial situation

- Women are 55% more likely to say they don’t know if they have saved enough

- Younger people are eight times more likely to use social media for financial advice

- 44% of under-40s want to retire by 60

- Women and younger people are more willing to reskill but are also worried about associated costs

The respondent profiles to the Pulse Poll were homogeneous and predominantly included those who had undertaken higher education, were in more senior positions, were likely to be in employment at major global organizations and with a high level of individual agency and financial literacy.

While there are some sample limitations, the survey suggests how the findings can help start a conversation about the challenges faced and can contribute to the development of solutions for the population this group of respondents represents.

Recommendations for Governments and Employers

As people are living longer lives, business and government need to restructure their approach to later life planning. Failing to adopt a multi-stakeholder approach towards longevity will inevitably result in a significant portion of people retiring into poverty.

Recommendations are cover three key areas of work and retirement including quality of life, purpose and financial resilience.

Government

- Facilitate upskilling of older workers and clamp down on ageism

- Provide incentives for employers to offer more robust leave policies for caregiving needs

- Explore the wider use of default auto-enrollment and default investment strategies to increase and maximize savings

- Establish safety nets such as minimum pension levels provided by government

- Enact enabling legislation to make all jobs flexible for longer-life working if desired and to accommodate all life-stage needs

- Offer digital skills training and equipment to ensure equitable access to opportunities for all

Employers

- Implement programmes offering support such as carers’ leave, information and advice for those who have caregiver responsibilities

- Understand what impact the company’s retirement plan design has on the trajectory of retirement-readiness and labour flow – check if people can actually afford to retire

- Provide flex-work programmes for caregivers, such as job-shares; allow part-time workers to contribute to defined contribution plans; provide training programmes for workforce re-entry, similar to those for early-career employees

- Implement and review financial wellness programmes to:

- Cover specific life-stage needs that account for gender, cultural and ethnicity differences

- Consider personalized models to show the impact of different working arrangements and retirement ages on pay and pension

- Cater to low-income earners who are likely to need the most support saving and planning for retirement

Individuals can also reimagine what their longer lives might look like as the three-stage life of school, work and retirement makes way for a multi-stage life that could include lifelong learning, career breaks and new occupations in later life. This includes pursuing upskilling and reskilling opportunities, as well as prioritizing retirement and pension planning if possible.

Increasing longevity globally will require new innovations and solutions to address how people can stay financially resilient in a retirement that may be 20 years longer than their grandparents. With supportive actions from government and employers, individuals will have a chance to try new approaches to longer lives and reassess how they want to study, live, work, save and retire in ways that are different from what has been done in the past century. For the Silo, Madeleine Hillyer/World Economic Forum.