Few Canadians are immune to the rising cost of living, according to a new report from Statistics Canada, with 9 percent of those in the highest income quintile considering using a food bank.

Data from spring 2024 shows that while 42 percent of Canadians are concerned over rising food prices, about 9 percent of those in the highest income bracket report they may have to turn to a food bank or similar community organization for help. That number rises to 14 percent for those in the second-highest income bracket, StatCan said.

A cart is filled with bags of food during a Thanksgiving food drive for the Ottawa Food Bank, at a grocery store in Ottawa on Oct. 7, 2023. The Canadian Press/Justin Tang

Nearly half of Canadians report struggling to meet day-to-day expenses, up 12 percentage points from 2022 to 45 percent.

The survey found that the number of Canadians who feel “quite a bit” or “extremely” stressed over financial issues increased slightly since 2022, from 33 percent to 35 percent this year.

Families with children and those living with a disability are struggling the most, StatCan said.

Fifty-five percent of families with children say rising costs have impacted their ability to cover daily expenses, compared to 42 percent of households without children and 37 percent of single Canadians.

Shrinkflation– a sneaky way of charging more by giving less. General Mills shrunk its “family size” boxes from 19.3 ounces to 18.1 ounces. Justin Sullivan/Getty Images

Those with disabilities are also more likely to be facing financial difficulties, with 57 percent saying they are struggling to meet daily costs, compared with 43 percent of those without a disability.

Housing is one of the biggest concerns Canadians cite, with nearly four in 10 saying they are concerned about their ability to afford a home because of rising prices. The number has risen from 30 percent in 2022 to 38 percent this year.

StatCan found that renters are more uneasy about increasing prices than homeowners, with nearly two-thirds of renters “very” concerned over housing affordability compared with about one-third of homeowners.

Food prices are another top concern for those surveyed, with more than one in five Canadians saying they may not be able to afford groceries. The number has risen to 23 percent, up from 20 percent two years ago.

Of those worried about food prices, 8 percent say they are very likely to need help from an organization such as a food bank. Another 15 percent say they are somewhat likely to need community help.

More than one in four families with children say they expect to turn to food banks and similar organizations, compared to one in five for other household types, StatCan said.

About one-third of Canadians with a disability say they expect to get food from a community organization in the next six months, compared to one in five of those without a disability, the agency said. For the Silo, Chandra Philip / The Epoch Times. The data was collected between April 19 and June 3.

Related Stories

Rent Prices Hit Record High Across Canada, New Report Finds

Grocery ‘Shrinkflation’: Some Products Reduced Over 20 Percent in Size, Study Finds

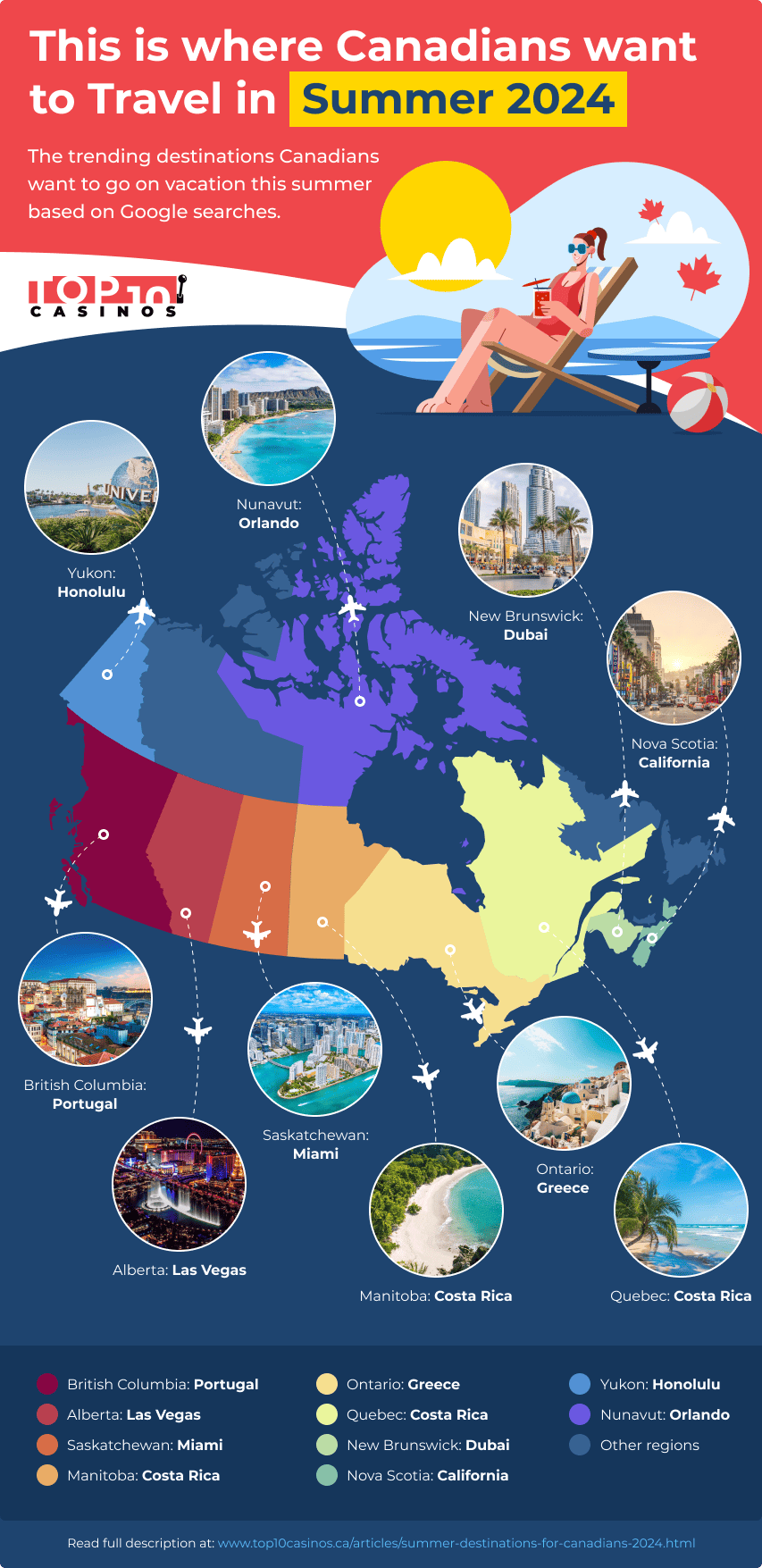

The Cold European Country of Iceland Has the MOST Search Increases – Ranking Above Beach Favorite, Mexico Beaches, relaxing by the pool and all you can drink cocktails are usually synonymous with summer, but according to our study, Canadians want to escape the heat in favor of colder climes. With an average of over 689,980 monthly searches and a huge 122% increase in 30 days, Iceland surprisingly ranks in front of Mexico as a go-to vacation destination this summer. Looking at why Canadians might be interested in visiting the land of ice and fire, searches for ‘northern lights’ are up 10,900% and people looking at ‘portugal v iceland’ have increased 1,043% on Google. According to the regional data, Niagara Falls residents in particular are looking for a totally unique experience this summer, with searches for ‘Iceland summer vacation’ up 200% since the same time last year.

The Cold European Country of Iceland Has the MOST Search Increases – Ranking Above Beach Favorite, Mexico Beaches, relaxing by the pool and all you can drink cocktails are usually synonymous with summer, but according to our study, Canadians want to escape the heat in favor of colder climes. With an average of over 689,980 monthly searches and a huge 122% increase in 30 days, Iceland surprisingly ranks in front of Mexico as a go-to vacation destination this summer. Looking at why Canadians might be interested in visiting the land of ice and fire, searches for ‘northern lights’ are up 10,900% and people looking at ‘portugal v iceland’ have increased 1,043% on Google. According to the regional data, Niagara Falls residents in particular are looking for a totally unique experience this summer, with searches for ‘Iceland summer vacation’ up 200% since the same time last year. Cuba Revealed as Canada’s Most Desired Beach Destination This Summer – Ranking Above Mexico and Costa RicaWith more than 712,000 monthly searches and an increase of 36% in 30 days, Cuba is revealed as Canada’s most desired beach vacation destination for summer 2024. According to the data, Canadians are researching long distance swimming in the country, with searches for ‘swim from cuba to florida’ up 3,500% and ‘vacations to cuba’ up 333%.

Cuba Revealed as Canada’s Most Desired Beach Destination This Summer – Ranking Above Mexico and Costa RicaWith more than 712,000 monthly searches and an increase of 36% in 30 days, Cuba is revealed as Canada’s most desired beach vacation destination for summer 2024. According to the data, Canadians are researching long distance swimming in the country, with searches for ‘swim from cuba to florida’ up 3,500% and ‘vacations to cuba’ up 333%. The Dominican Republic Ranks in Top 10 With over 97,000 monthly searches for ‘The Dominican Republic summer vacation’ and a 35% increase in the past month – it’s evident the Caribbean Island will be one of the most coveted destinations by Canadians this summer, which is why it features in the top 10. When analyzing search trends on a city level, Montréal has seen a 25% increase in residents’ searching for the beautiful beach spot, and Ottawa shows a 20% surge.

The Dominican Republic Ranks in Top 10 With over 97,000 monthly searches for ‘The Dominican Republic summer vacation’ and a 35% increase in the past month – it’s evident the Caribbean Island will be one of the most coveted destinations by Canadians this summer, which is why it features in the top 10. When analyzing search trends on a city level, Montréal has seen a 25% increase in residents’ searching for the beautiful beach spot, and Ottawa shows a 20% surge.

Las Vegas Named the Most Desired Destination The gambling capital of the world is the most searched for city across the 10 cities of Alberta with searches spiking by nearly half (48%) since the same time last year. With 1.7 million monthly searches and a 12% increase in Canadian’s searching for the desert oasis summer vacation, Las Vegas has seen a 6% increase in search increases than topspot New York, the city also ranks above favorites Cuba and Mexico.

Las Vegas Named the Most Desired Destination The gambling capital of the world is the most searched for city across the 10 cities of Alberta with searches spiking by nearly half (48%) since the same time last year. With 1.7 million monthly searches and a 12% increase in Canadian’s searching for the desert oasis summer vacation, Las Vegas has seen a 6% increase in search increases than topspot New York, the city also ranks above favorites Cuba and Mexico. Greece Ranks Second as Research Reveals European Summer Vacations Most Popular with Ontario ResidentsThe data shows there’s a rapid number of Canadians looking to experience a European summer vacation this year, with both Greece and Italy coming up top in Ontario. Looking at the most searched for destinations, searches for Greece’s picturesque Santorini have increased by 67% since the same period last year across Canada, and Italy’s Rome have spiked 25%.

Greece Ranks Second as Research Reveals European Summer Vacations Most Popular with Ontario ResidentsThe data shows there’s a rapid number of Canadians looking to experience a European summer vacation this year, with both Greece and Italy coming up top in Ontario. Looking at the most searched for destinations, searches for Greece’s picturesque Santorini have increased by 67% since the same period last year across Canada, and Italy’s Rome have spiked 25%. Costa Rica is the Most Desired Destination by Two ProvincesFilled with rugged rainforests, pristine lagoons and beautiful beaches, it’s little wonder the Central American country of Costa Rica is the most desired by two parts of Canada. Provinces of Quebec and Manitoba both had Costa Rica as their favorite destination, with searches for the tropical country up by an average of 81% across 10 cities in Quebec since the same time last year. Looking at locations on a city level, searches for ‘all inclusive Costa Rica vacations’ are up 300% in Quebec City, highlighting a need to escape busy metropolitan life.

Costa Rica is the Most Desired Destination by Two ProvincesFilled with rugged rainforests, pristine lagoons and beautiful beaches, it’s little wonder the Central American country of Costa Rica is the most desired by two parts of Canada. Provinces of Quebec and Manitoba both had Costa Rica as their favorite destination, with searches for the tropical country up by an average of 81% across 10 cities in Quebec since the same time last year. Looking at locations on a city level, searches for ‘all inclusive Costa Rica vacations’ are up 300% in Quebec City, highlighting a need to escape busy metropolitan life. Toronto’s 3 Favorite Summer Vacation Spots are all City DestinationsResidents hailing from Ontario’s capital, Toronto, are interested in keeping the summer city spirit alive, with 3 favorite destinations also being city spots. According to the data, Toronto’s favorite destination is Dubai with a 49% increase in searches since the same time last year. Closely followed by Rome (22%), and Miami (20%).

Toronto’s 3 Favorite Summer Vacation Spots are all City DestinationsResidents hailing from Ontario’s capital, Toronto, are interested in keeping the summer city spirit alive, with 3 favorite destinations also being city spots. According to the data, Toronto’s favorite destination is Dubai with a 49% increase in searches since the same time last year. Closely followed by Rome (22%), and Miami (20%).