|

Tag Archives: income

Fundraising Survey Shows More Canadians Are Giving But Giving Less

(Toronto, Ontario) Seven in ten Canadians have given to charity in 2018, and almost half of donors are open to different sorts of giving approaches than just the traditional solicitation letter, according to the 2018 What Canadian Donors Want Survey, conducted by the Association of Fundraising Professionals (AFP) Foundation for Philanthropy – Canada in partnership with Ipsos.

The survey, which featured 1,500 Canadians age 18 or older, found that the percentage of people giving to charity in 2017 jumped by four points from the 2015 survey, returning to previous giving levels. Even as more Canadians are giving, they are giving less—an average of $772 cdn in 2017 compared to average giving levels of $924 cdn in 2015 and $726 cdn in 2013.

Eighty percent of donors give to more than one cause, with 23 percent giving to 4-5 charities and 13 percent supporting 6 or more causes. The top recipients of donations are social services and health charities—more Canadians (59% and 57%) gave to those causes than any other.

Overall, Canadians are more confident in the charitable sector than ever before, with nearly eight in ten respondents (78%) saying they’re confident in the organizations that comprise the charitable sector. That figure represents a five-point increase from 2015 and is significantly higher than confidence in the private sector (67%) or the public sector (60%).

“Overall, the survey shows a Canadian population that is very supportive of the work of the country’s charities and a good understanding of how charities work to support communities,” said Roger Ali, CFRE, chair of the AFP Foundation for Philanthropy – Canada. “However, there are signs that donors are changing how they want to give and interact with charities, and the sector needs to understand and adapt to these changes so that we remain relevant to the people who support us and the people we serve.”

Changes in Volunteering, Giving Behavior

One troubling sign is a drop in volunteerism rates. According to the survey, one-third of Canadians volunteered their time to a charity or non-profit in the past 12 months and spent an average of 88 hours—down precipitously from 110 hours in 2015. “We’ll be watching this closely in our next survey to see if this is a one-time drop or a trend,” Ali added.

Canadians continue to change in how they want to be approached for donations. While 44% express a preference for traditional requests, such as mail, one quarter prefer a more personal approach like peer-to-peer contact or crowdfunding. Three in ten (31%) say they’re open to anything, having no specific preference.

Fundraising preferences vary significantly by age. Baby Boomers (54%) are the most likely to prefer being solicited through traditional requests, compared to Gen X’ers (43%) or Millennials (33%). By contrast, Millennials (17%) lead the way on crowdfunding, preferring this option to a greater extent than their Gen X (11%) or Boomer (5%) counterparts.

Perceptions of Charity Roles, Performance

Many underlying views on charities have remained relatively stable over time. Three-quarters of Canadians continue to agree that charities play an important role in society to address the needs not being met by the government, the public sector or the private sector. Majorities also believe that charities are trustworthy (61%) and act responsibly with the donations they receive (63%).

Canadians are more divided on how much charities spend on their programs and services vs. how much they spend on supplies, administration, salaries and fundraising. A growing majority (58%, up six percentage points from 2015) trust charities on how much they say they spend money on programs and overhead.

However, about a third of Canadians (34%, down 4 points) are less trusting, indicating that charities overstate how much they spend on the cause or programs (24%), or that charities are being intentionally misleading (10%). Yet, when presented with factors and asked how important each one is in evaluating a charity’s effectiveness, Canadians placed more emphasis on a charity’s ability to achieve its mission and create impact than managing its operation or its fundraising.

“Donors are looking for charities that create impact to change the world for the better,” said Lorelei Wilkinson, CFRE, chair of the AFP Foundation for Philanthropy – Canada Research Committee. “But it’s always clear that they keep a careful eye on administrative costs and a charity’s operations. The charitable sector needs to do a better job of explaining that overhead costs are essential for growth and sustainability —for things like equitable salaries, updated computer equipment, etc.— as part of being efficient with their use of donor dollars.”

Looking Ahead

Almost half of Canadians (46%) indicate that they are very likely to give in the next 12 months, while another one-third (34%) are somewhat likely to donate. However, 59% say they are also concerned about the economy, which may force them to reassess their giving plans.

A considerable number of Canadians (42%) proactively seek out information on the cause/charity and contact them to donate, while six in ten (58%) say the charity approaches them and they donate based on the information they receive. When looking for information on charities they support, Canadians continue to rely on online information (75%) as opposed to family, friends or colleagues (39%).

Social Media

The 2018 What Canadian Donors Want Survey also asked general questions about Canadians’ use of social media.

Similar to 2015, eight in 10 Canadians (81%) have a social media account. This applies across every age group, from 91% of Millennials through to 85% of Gen X’ers and 70% of Baby Boomers. Women (84%) are more likely than men (78%) to maintain at least one social media account.

Facebook dominates the Canadian social media landscape: three in four Canadians (75%) say they have a Facebook account, placing it well ahead of Twitter (29%), Instagram (28%), Reddit (5%) or other social media (13%).

Nearly two in ten Canadians on social media (18%) have donated to a charity in response to a request that came through their social media account. Millennials (23%) and Gen X Canadians (19%) are more likely than Baby Boomers (13%) to have made a charitable donation in response to a social media invitation or post.

“As generations age, we expect that email and social media will continue to become more prevalent in fundraising,” said Mary Bowyer, CFRE, member of the AFP Foundation for Philanthropy – Canada Research Committee. “For now, we’re seeing a blend of different approaches, and the most successful charities will be those who personalize their appeals based on what individual donors want, meaning a mix of mail, email, videos, Tweets and other communications.”

About the Survey

The 2018 What Canadian Donors Want Survey was based on a poll conducted between October 10 and October 17, 2017, on behalf of the AFP Foundation for Philanthropy – Canada. For this survey, a sample of 1,500 Canadians aged 18+ was interviewed. Weighting was then employed to balance demographics to ensure that the sample’s composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe.

The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ±2.5 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

The Association of Fundraising Professionals (AFP) is the largest international association of fundraising professionals in the world. AFP has over 33,000 members world-wide, with 3,800 in Canada. AFP promotes the importance and value of philanthropy, and enables people and organizations to practice ethical and effective fundraising. AFP Canada was formally created in 2017.

As the philanthropic arm of AFP, the AFP Foundation for Philanthropy – Canada supports many programs and services through its fundraising efforts. Fulfilling the promise of philanthropy by funding programs and services in the areas of research, diversity & inclusion, supporting the profession and leadership. To find out more, please visit www.afpnet.org.

Best Online Casino In Canada Where Gamblers Win Real Money

Canadians respect the law. Those, who like gambling, do it as well. As soon as land casinos in this country are legal, they feel free playing in various gambling clubs placed in different provinces. Nevertheless, it is much more convenient for many players to stay at home and use the pros of casinos that work online.

However, as the situation with online gambling business legality is still vague, not to take any risks of breaking laws, Canadians prefer to play in their casinos that have licenses and use playing sites that welcome them and let win real money. Baocasino Canada is exactly this new reliable resource.

Legal online casino Сanada for real money

Canada is inherently a country that offers its residents and guests a huge selection of diverse entertainment options and a pleasant pastime. Among such options, a special place is occupied by numerous casinos and gambling houses.

Besides, Canadians take care of those people, who want to gamble online. Numerous advantages are offered to them here. When they choose Baocasino, they can use all the advantages of this gambling site, including earning crypto, taking part in tournaments and getting the best prizes in Bao way quest.

No taxes for players

Canada is a real paradise for those players, who win real money in online casinos regularly. If in other countries, especially in the USA, the closest to Canada neighbor, gambling tax in some states can reach 50%, here the situation is different.

However, there is one “but” even here. Yes, in Canada, there is no tax on winnings, but if Poker is a person’s main source of income, then he, as an individual, must pay income tax, the amount of which is directly proportional to the income for one year.

Progressive tax rates applied at the federal level:

Taxable Income – Rate:

- Up to $ 42.707 – 15%;

- From $ 42,707 to $ 85,414 – 22%;

- From $ 85,414 to $ 132 406 – 26%;

- From the sum more than $ 132,406 – 29%.

However, even in this case, the taxes in Canada are lower than in many countries (taxes in the gambling sphere, for sure). Canadian residents, who gamble in the casinos with licenses of other countries, should also follow these laws. Baocasino, with its license from Curacao, being a legal playing site, respects the laws, and follows them.

Bonuses for gamblers

Playing in the best online legal casinos in Canada, gamblers can claim a variety of bonuses, and get them, withdrawing money following wagering requirements. Those, who register in Baocasino for gambling, not for fun, can also get these bonuses.

Before claiming them, it is recommended to read about the Bonus policy of the casino. In brief, it is as follows:

- When a gambler starts playing in Bao with an additional bonus that is over 20 free spins and 100% deposit bonus, this bonus will be added to the first made deposit;

- Wagering bonus, the player cannot make the bet over 5 USD or 7, 7 CAD;

- Withdrawing money that is won thanks to bonuses usage, the rules works — the maximum withdrawal here is 80 CAD or 50 USD;

- Using bonuses, Canadian players must not use any strategies when gambling. If Baocasino finds out that the strategies were used, the win is terminated.

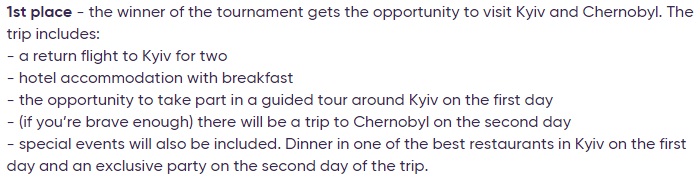

Exciting adventures also offered as prizes

If winning money isn’t amazing enough then take a look at Baocasino’s prize pool: it includes exclusive adventures such as this month’s Chernobyl Tournament. The First place winner is in for a unforgettable trip of a lifetime.

The variety of games

Baocasino that offers its registered players from Canada the variety of games that can be found in other gambling resources, but here, players have a chance to earn Bitcoin and some alternative cryptocurrencies like Litecoin, Ethereum, Dogecoin, and Bitcoin Cash.

They can do it when choosing crypto as the main currency for gambling or playing special crypto games, which are available in this casino. If a player wins in cryptocurrency, he can withdraw his win instantly.

Baocasino is the best choice for those Canadians, who are seeking for a reliable and legal online casino with a number of cool games, bonuses and interesting promotions. After registration, all these pros become available to a new user. For the Silo, Ella Wilson.