World Economic Forum’s EDISON Alliance Impacts Over 1 Billion Lives, Accelerating Global Digital Inclusion.

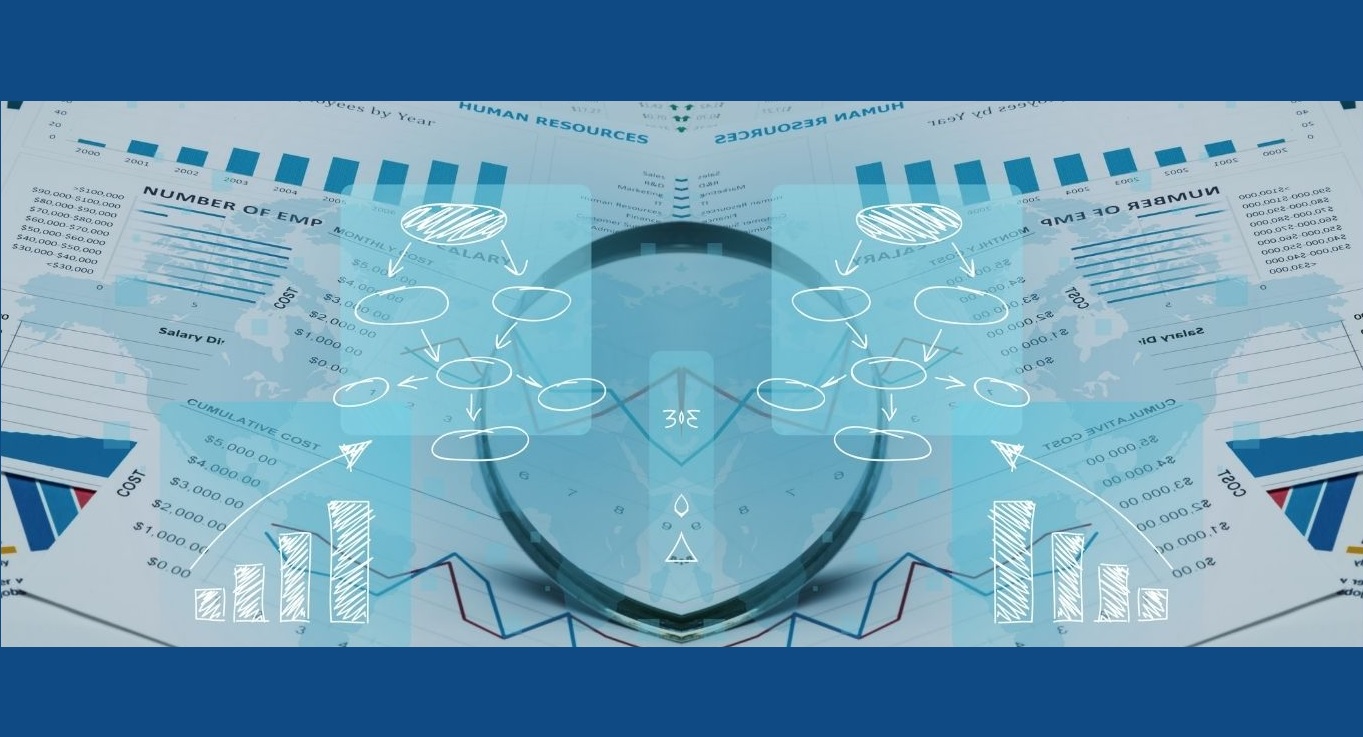

- The EDISON Alliance has connected over 1 billion people globally to essential digital services like healthcare, education and finance through a network of 200+ partners in over 100 countries.

- Investments in bridging the universal digital divide could bring $8.7 trillion usd/ $11.7 trillion cad in benefits to developing countries, home to more than 70% of the Alliance’s beneficiaries.

- The Alliance’s 300+ partner initiatives, including digital dispensaries in India, economy digitalization programmes in Rwanda and blended learning in Bangladesh, continue to shape a digitally equitable society.

- Follow the Sustainable Development Impact Meetings 2024 here and on social media using #SDIM24.

New York, USA, September 2024 – The EDISON Alliance, a World Economic Forum initiative, has successfully connected over 1 billion people globally – ahead of its initial 2025 target – to essential digital services in healthcare, education and finance in over 100 countries. Since its launch in 2021, the Alliance has united a diverse network of 200+ partners from the public and private sectors, academia and civil society to create innovative solutions for digital inclusion.

Despite living in a digitally connected world, 2.6 billion people are currently not connected to the internet.

This digital exclusion impacts access to healthcare, financial services and education, contributing to significant economic costs for both the individuals involved and their countries’ economies.

Klaus Schwab- German mechanical engineer, economist and founder of the World Economic Forum.

“Ensuring universal access to the digital world is not merely about connectivity, but a fundamental pillar of equality and opportunity,” said Klaus Schwab, Founder and Chairman of the World Economic Forum. “Let us reaffirm our commitment to ensuring that every individual, regardless of their geographic or socioeconomic status, has access to meaningful connectivity.”

The Alliance has made substantial progress in South Asia and Africa.

In Madya Pradesh, India, The EDISON Alliance fostered the Digital Dispensaries initiative, a collaboration between the Apollo Hospitals Group and a US telecom infrastructure provider. This partnership has successfully delivered quality and affordable healthcare, improving patient engagement, addressing gender health disparities and optimizing patient convenience, and making it a scalable model for delivering patient-centric healthcare through digital solutions. Other partner projects improved digital access through economy digitalization programmes in Rwanda, provided solutions for bridging the education gap in Bangladesh with blended learning techniques and explored solutions to reduce financial exclusion in Pakistan.

“Everybody, no matter where they were born or where they live, should have access to the digital services that are essential for life in the 21st century,” said Hans Vestberg, Chair of the EDISON Alliance, Chairman and CEO of Verizon. “Making sure that everybody can get online is too big a challenge for any one company or government, so the EDISON Alliance brings people together to find practical, community-based solutions that can scale globally.”

By driving digital inclusion through its 300+ partner initiatives, the Alliance contributes to unlocking the immense potential of the digital economy. Achieving universal internet access by 2030 could require $446 billion usd/ $600 billion cad, but would yield $8.7 trillion usd/ $11.7 trillion cad in benefits for developing countries. This highlights the significant potential of digital inclusion to drive economic growth and improve lives. The EDISON Alliance has made substantial contributions to this goal, with over 70% of its impact concentrated in developing nations.

The milestone of connecting 1 billion lives was initially targeted for 2025.

Achieving this ahead of schedule demonstrates the effectiveness of its partners, through collaboration and targeted projects, in bridging the digital divide and providing access to critical services to underserved communities.

Beyond digital access, the rapidly evolving technological landscape – marked by such advancements as artificial intelligence, presents opportunities and challenges. The EDISON Alliance remains committed to ensuring that marginalized communities can fully benefit from these developments and avoid being left behind. As technology continues to advance, the Alliance will focus on expanding digital access, fostering innovation and addressing the digital gender gap to create a more inclusive digital future.

About the Sustainable Impact Meetings 2024

The Sustainable Development Impact Meetings 2024 are being held this week in New York. Over 1,000 global leaders from diverse sectors and geographies will come together to assess and renew global action around the United Nations Sustainable Development Goals (SDGs) through a series of impact-oriented multistakeholder dialogues. The meetings are an integral part of the Forum’s year-round work on sustainable development and its progress.