Let’s Hope for Solid Hit from the PBO’s Third Swing at Carbon Tax Analysis

The “corrected” analysis by the Parliamentary Budget Office of the carbon tax and rebates is due soon. One hopes it will get more things right in this third crack at evaluating the government of Canada’s assurance that most Canadians will receive enough from the carbon tax rebates to cover their cost of paying the tax.

Reporting in 2022 and in an update last year, the PBO analysis confirmed the government assertion so long as induced economic effects from the carbon levy are not included. However, once the economic damage from the levy is included, the PBO concluded that the rebates fall short of keeping family budgets whole.

The PBO’s conclusion was seized on by Conservative politicians and others to justify calls to revoke the carbon tax. Now, more knives have come out. The NDP says it would scrap the tax on households and put the burden on large emitters, but it does not yet explain how it would square that with the current big-emitter carbon tax. And BC, where carbon taxing began in Canada, has said it would drop the tax if Ottawa removed the legal requirement.

Much is at stake with this third PBO swing.

After the second report, the PBO admitted that its analysis had included, in addition to the carbon tax on households, the tax on large emitters as well. The economic impacts had been taken from work passed over to the PBO by Environment and Climate Change Canada (ECCC), which included the effects of the tax as applied to both industrial and household payers. The budget officer said the error was small and had little consequence for the analysis and promised a corrected version this fall.

The Canadian Climate Institute estimates that 20-48 percent of the emissions reduction by 2030 will come from the levy on large emitters compared to 8-14 percent from households. Given the scale of the large emitters tax, it is likely that it has significant economic effects on any forecast. Fixing this should not, however, be the most consequential revision to its analysis.

The PBO’s first two efforts had an analytical asymmetry. It measured the economic cost originating in the tax, exaggerated as it turned out, but did not attempt to capture the economic benefits (not to mention any health gains) from the effects of the household carbon levy in mitigating climate change. Put differently, their work was, in effect, based upon the faulty premise that climate change brings no economic damage. The massive and growing costs of cleaning up fire and flood damage and adapting to the many other consequences of global warming bear evidence of such costs. The PBO could and should do its own analysis of those climate change costs and, hence, the benefits of mitigation. Or it could more easily tap into the substantial body of available literature.

Lowering Canada’s Gross Domestic Product

In Damage Control, the Canadian Climate Institute estimated climate change would lower the Gross Domestic Product by $35 billion from what it would otherwise have been in 2030; the impact would rise to $80 to $103 billion by 2055. Through cutting emissions, the household carbon tax will reduce this cost. International literature is rich, and the PBO could review it for applicability to Canada. As but one example, Howard and Sterner’s (2017) meta-analysis on the impacts of climate change concluded most studies underestimated them. Their preferred estimate points to a GDP hit of between 7 and 8 percent of GDP if there are no catastrophic damages and 9 to 10 percent if there are. Conceptual thinking is also advancing. Consideration is being given to there being “tipping points” where a certain degree of climate change may have much more non-linear dramatic economic effects. Some, like Stern and Stigliz, even question the worth of comparing an economic outlook with mitigation action against a status quo baseline as the PBO has done. They argue that without mitigation, there may not be a sustainable economic outcome.

Finally, those still inclined to think that a corrected Fall 2024 PBO report will provide ammunition to “axe the tax” need to ask themselves two questions.

First, is there value in the emissions reduction resulting from the household carbon tax? The Canadian Climate Institute concludes that the 8-14 percent contribution to emissions reduction by 2030 will grow in later years. Even with the tax and all the other policies announced to date, there is a 42-megatonne gap in Canada’s 2030 emissions reduction target. More than 200 Canadian economists signed an open letter asserting that “carbon pricing is the lowest cost approach because it gives each person and business the flexibility to choose the best way to reduce their carbon footprints. Other methods, such as direct regulations, tend to be more intrusive and inflexible, and cost more.” If not the household carbon tax, then what else?

Let us hope the PBO’s third carbon tax report gives evidence to form a more balanced perspective. For The Silo, Don Drummond/C.D. Howe Institute.

Don Drummond is the Stauffer-Dunning Fellow in Global Public Policy and Adjunct Professor at the School of Policy Studies at Queen’s University and a Fellow-In-Residence at the C.D. Howe Institute.

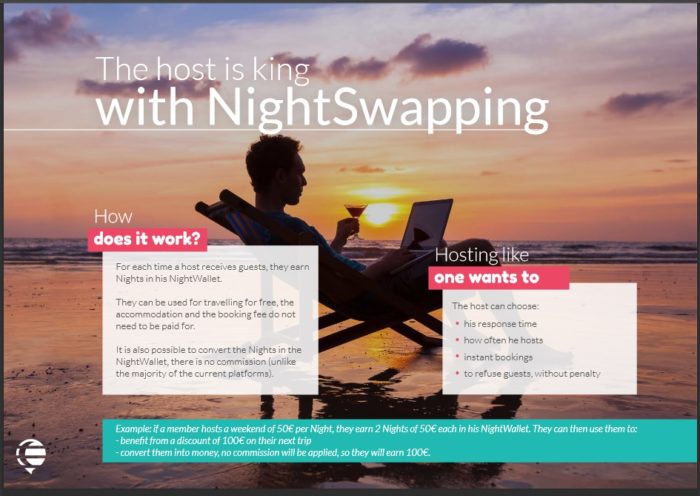

Nights Exchange Leader NightSwapping Acquires MyTwinPlace NightSwapping is the first Nights exchange community with more than 250,000 members throughout 160 countries. It pioneered a new concept in 2012 which is unique in the sharing economy travel market. Read the

Nights Exchange Leader NightSwapping Acquires MyTwinPlace NightSwapping is the first Nights exchange community with more than 250,000 members throughout 160 countries. It pioneered a new concept in 2012 which is unique in the sharing economy travel market. Read the