Having side cash from time to time, or even better continually, is a great source of wealth.

Not only that it enables you to collect money for something that you really need, but it really can boost your emergency fund, or just let you spoil yourself from time to time.

To get extra money and get it fast you can do several different jobs from ride-share services to doing some online surveys – they all pay differently, but they all will get you extra money.

Here are some of the best ways to earn money quickly this year.

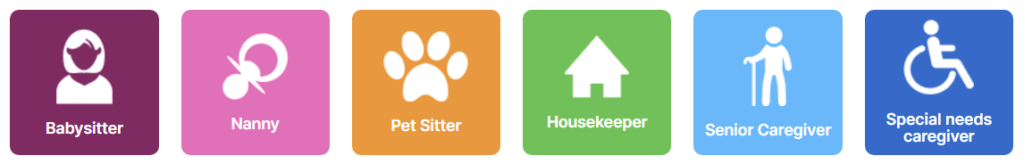

Start With Home Care Services

You will be surprised to learn that additional help in-home care areas are always more than welcome.

With Boomers retiring and Millennials taking over the job market, it seems only logical for Millennials to provide additional care for senior citizens. Not only that you can find home care services jobs in Canada easily and fast, but next to quick money this type of job will also bring you a safe working environment, great companionship, and also provide you with a flexible work schedule, and an opportunity to learn new skills.

Sell Your Used Items

This is an old one, but a gold one.

Use well-known offline and online marketplaces, such as Craigslist, to sell items that no longer serve you.

You may not enjoy them anymore, but someone will be more than happy to welcome an original lamp from the 19th century or a preserved CD from ’90.

Do your best to present the product well:

- Take great photos

- Provide an accurate and brief description

- Post items online

Pro tip: High-quality clothes and perfumes are the first to sell

Think also about selling old electronics, including tablets, fitness trackers, game consoles, and laptops.

The great thing about electronics is that if you cannot sell them, you can always trade them and get something that you can actually sell.

Freelance Online

Use large platforms for freelancers such as UpWork and Fiverr to get an online gig.

These sites are more than packed with different opportunities for people of various skills to land a job. Think about a position such as a virtual assistant, or a data entry assistant.

Good to know: It may take a while to get your first job, but in the long run this can be an ongoing source of additional money.

10 Ideas On How To Make Money Quickly

- Sell unused gift cards

- Be an affiliate marketer

- Take online surveys

- Tutor students

- Delivery

- Sell on eBay

- Sell photos

- Teach English online

- Pet sitting

- Dog Walking

There are dozens of different ways to earn money quickly and continually.

Before you start, be honest and know how much time you can invest in working on the side.

Once you determine that know what skills you can actually use to get that extra money. From there, find a place where your skills can be put to good use and sold.

In the meantime, check your loft and see what you have around collecting dust and sell.