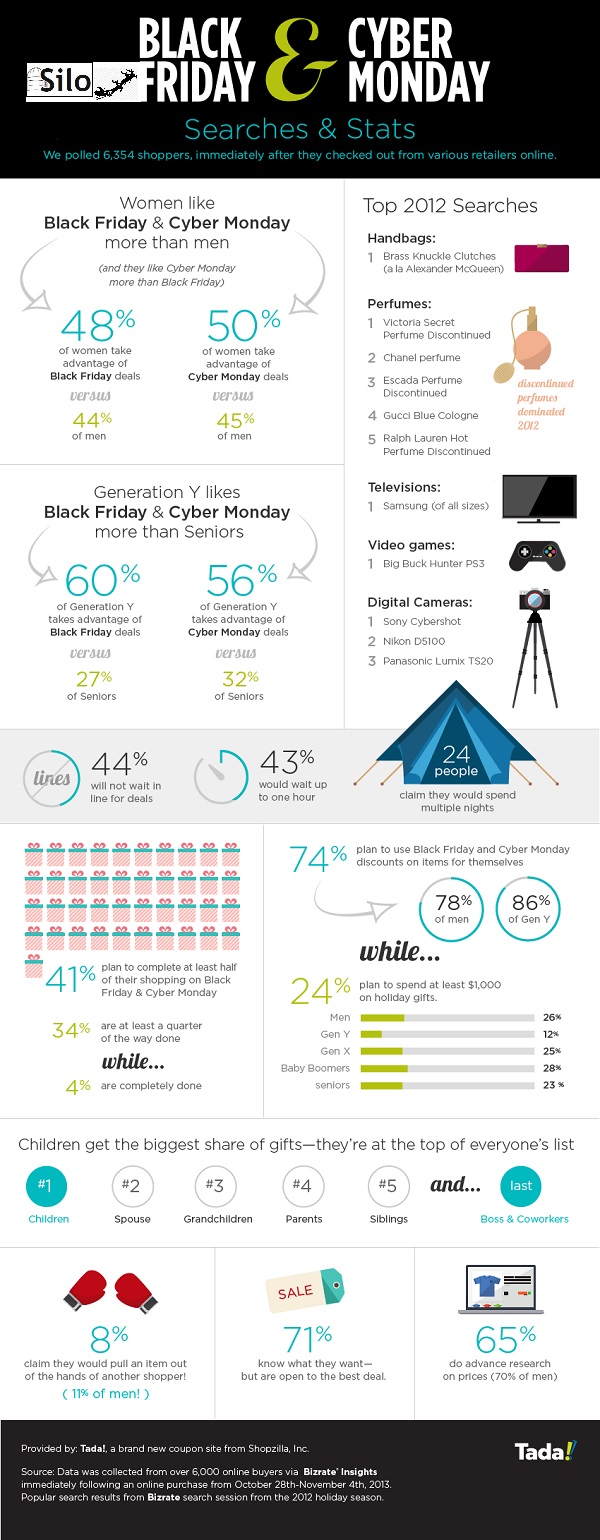

Black Friday and Cyber Monday are a cultural phenom. One that American and (in the past few years) hard-boiled Canadian consumers look forward to each year. They brave the crowds, set out a savings mission plan and shop like a thrifty gladiator entering the battle arena of value.

WHEN IT COMES TO BLACK FRIDAY/CYBER MONDAY…

While images of people camped out in Walmart parking lots regularly dominates the Black Friday news cycle (as well as trampling and fights), we wanted to find out how people really intend to spend these consumer holidays-and more importantly, how much they intend to spend. We also looked at Holiday Gift searches from the last few years on our sister site-interestingly, there’s apparently a big market for discontinued perfumes.

SOME INTERESTING FACTS FROM THE STUDY

* Men are much more open to violence on Black Friday/ Cyber Monday: One out of 10 guys (11%) would pull something out of the hands of another shopper.

* 86% of Generation Y intends to use Black Friday and Cyber Monday discounts on items for themselves.

* Men are the most generous: 26% of guys plan to spend at least $1,000 on holiday gifts.

* Very few people are procrastinating: While 4% claim they’re already finished with their holiday shopping, 41% intends to complete it on Black Friday/Cyber Monday.

* 43% will wait up to an hour on Black Friday; 24 people said they’d willingly camp out for MULTIPLE NIGHTS.

* Bosses and co-workers are at the bottom of everyone’s shopping list: Children, understandably rule (followed by spouses/significant others).

The following info-graphic is based on responses from 6,354 online shoppers who were surveyed last year immediately after checking out. Odds are things haven’t changed much this year. Here’s more from our friends at Tada, they are awesomely obsessed with reporting on all the things that online shoppers value. For the Silo, shopzilla.com/Jarrod Barker.