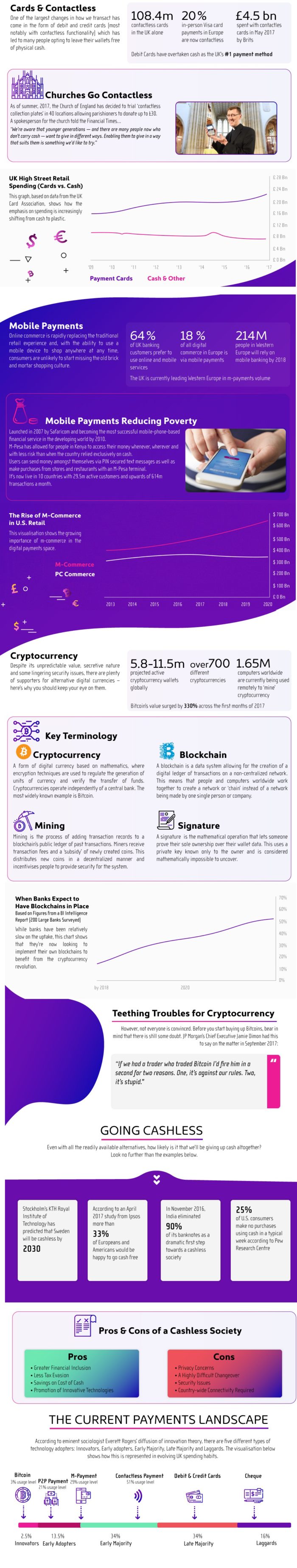

Take a look at these transactional trends to see how you might be spending your money in the future.

What does the future hold for the way we pay?

Paying for your purchases used to be to the most straightforward task around, you’d exchange your coins with the cashier and in return you’d receive your goods. Simple. But today, a modest transaction can involve some serious tech.

Whilst everything in the world seems to be making a switch to digital, money is no exception. Gone are the days of signing signatures, punching in pins and certainly, counting coins, but the advancements show no sign of stopping. As contactless method currently seems to offer the most convenient method of payment – it begs the question of what could possibly come next.

The use of physical cash is dwindling as more and more options become available to consumers.

Consider how the Corona virus lock downs have also affected the use of physical cash: businesses and retail either favor interac and credit cards or outright refuse the use of cash transactions. Look to the infographic below for three of the most prominent examples of the way our spending habits are currently evolving. For the Silo, Danielle Mowbray /creditangel.co.uk