May 9, 2023 – Investor-state disputes are proliferating around the globe as business investors seek redress for government actions they deem unfair or contrary to investment agreements, according to report from the C.D. Howe Institute. In “Investor-State Disputes: The Record and the Reforms Needed for the Road Ahead,” author and C.D. Howe Institute Senior Fellow Lawrence L. Herman reviews the record of investor-state dispute settlement (ISDS) procedures, the criticisms directed at them, and the reforms required.

“Despite concerns and criticism, ISDS procedures in international investment agreements are an important development in global governance that should continue to be a part of our international fabric,” says Herman.

Herman examines both Canadian and global cases involving ISDSs, which give private parties the right to bring binding arbitration against governments under International Investment Agreements (IIAs). These rights can be invoked when investors allege a lack of fair and equitable treatment, discrimination or expropriation without adequate compensation contrary to a country’s treaty obligations.

“ISDS has become a significant feature for investments, particularly into developing countries in many parts of the world,” according to Herman.

“However, because of the rights given to private parties, these agreements have become increasingly controversial – especially in an era of increasingly expanding governmental measures on climate change, sustainability, human rights and other issues impacting foreign investors and their investments in one way or another.”

In response to these concerns, multilateral, regional and bilateral efforts are making continuing improvements to ISDS mechanisms when it comes to efficiency, transparency and aspects such as permanent appointments and a system of appeals.

“While some countries have embarked on a program of terminating their bilateral investment agreements, these agreements will continue to remain as a part of the international fabric in many parts of the globe,” says Herman. “They are an important development in global governance and, even if not perfect, they not going to disappear in spite of concerns and criticisms.”

Creating permanent rosters of tribunal members as well as adding an appellate review processes to existing IIAs would help improve ISDS procedures. Short of this, Herman says ongoing efforts could include: i) promoting model arbitration clauses to reduce legal uncertainty and enhance consistency and predictability of outcomes; ii) developing codes of conduct and best practices for adjudicators plus rules to ensure their independence; and iii) making sure appointments to tribunals are of highest quality. Governments should also publicly support the value of third-party arbitration as an objective and neutral process that leads to peaceful resolution of differences, he adds.

Ultimately, investment protection treaties are about risk mitigation with host states bound by treaty to respect obligations of fair and equitable treatment and other rule-of-law standards and providing investors with a degree of assurance, says Herman. “While there are legitimate questions about the process and whether and to what degree investment treaties accomplish these objectives, these suggestions can assist in providing ways forward,” he concludes.

There are some 2,500 international investment agreements (IIAs) in force around the world, whether as stand-alone treaties or incorporated into bilateral or regional free trade agreements (FTAs). They are a significant feature of the international business scene.

A main feature of these agreements is to allow foreign investors to invoke binding arbitration where it is alleged that the host governments have breached fair and equitable treatment and other treaty obligations towards the investors. This is known as Investor-State Dispute Settlement or “ISDS”.

The process gives foreign investors comfort that if things go wrong in host countries, they have recourse to neutral, third-party dispute resolution. It thus provides important elements of risk reduction for foreign investors and their investments, notably aiding the flow of capital from industrialized countries to the developing world.

There has been dramatic escalation of investor arbitration claims over the last two decades. This makes it timely and useful to review the situation, looking at the value of ISDS as well as the criticisms that have emerged over the years. The conclusion is that IIAs and the arbitration process are valuable parts of the corpus of international order and will remain an integral part of the international business scene for the foreseeable future. The issue facing governments, therefore, is how to respond to criticisms by improving, as opposed to abandoning, the ISDS process. This paper suggests some pragmatic ways forward.

A Canadian company, First Quantum Minerals, and the government of Panama are reported to have settled a long-standing tax dispute allowing the company to resume operations at the Cobre Panama mine in that country. Earlier reports were that if the dispute was not resolved by negotiation, the company would invoke arbitration rights under the Canada-Panama Free Trade Agreement.

Had the dispute proceeded, it would have been another example of hundreds of arbitrations that have proliferated around the globe, initiated under various international investment agreements (IIAs) that give private parties the right to bring binding arbitration against governments under Investor-State Dispute Settlement ( ISDS) procedures. Those rights can be invoked, for example, where investors allege lack of fair and equitable treatment, discrimination or expropriation without adequate compensation contrary to that country’s treaty obligations.

In addition to investment treaties, numerous free trade agreements incorporate separate investment dispute settlement provisions, including the former North American Free Trade Agreement (NAFTA); the Canada-EU trade agreement (CETA); the Trans-Pacific Partnership (CPTPP) Agreement; and bilateral free trade agreements, such as those between Canada and countries like Chile and South Korea, among others.

As a consequence, ISDS has become a significant feature of the ground rules for investments in many parts of the world, particularly those made into developing countries. Because of the rights given to private parties, these agreements have become increasingly controversial, especially in an era of expanding governmental measures on climate change, sustainability, human rights and more that impact foreign investors and their investments.

In light of these developments, it is useful to briefly update the ISDS record with regard to Canada, look at what lessons might emerge, both in the global and the Canadian context, and suggest some elements to monitor as we go forward.

Criticisms Of ISDS Agreements

As investor arbitrations have proliferated, so have the criticisms, making ISDS one of the more controversial aspects of global governance. Here are some of the main ones:

- IIAs have given private companies broad rights to challenge host-country actions that can fall within legitimate fields of public regulation, especially now in an era of decarbonization and other national crises like COVID 19.

- The process involves one-way litigation, with no corresponding right of host countries to bring arbitration cases against investors for disregarding laws, practices and standards of business conduct.

- The growth of third-party financings of investor claims has stimulated, or at least encouraged, the initiation of ISDS cases.

- Investment agreements bypass the customary international law norm that requires claimants to first exhaust local remedies before bringing an international claim against a host country.

- The ISDS structure is defective because its ad hoc tribunals – put together to hear a particular case – make long-term, binding decisions affecting laws or policies enacted for the public interest.

- Arbitrators’ decisions are final and binding with no avenue of appeal, whether on errors of fact or of law.

- Because of its ad hoc nature, the system lacks institutional continuity. Public confidence in the system suffers.

- Arbitrators are appointed from a small — if not closed – pool of international lawyers who are free to act for private interests as counsel in other cases, leading to appearances of conflict and adding to diminished public confidence in the process.7

There are answers to these critiques but the over-arching response, as alluded to above, is that resolving investor-state disputes based on legal norms within an accepted procedural framework remains a significant achievement in the progressive development of international law. As observed in one analysis,

“During the last decade a number of the shortcomings have indeed been addressed and remedied. It is reasonable to assume that this has been done – at least partially – based on the realisation that investment treaty arbitration is the most efficient and reliable dispute settlement mechanism for disputes between foreign investors and host States. There is simply no better, realistic alternative.”8

As already mentioned, ISDS in its various manifestations provides an important element of stability and risk insurance when investing in jurisdictions where legal rules may not be mature or respected, aiding the flow of capital to developing countries and thus presumably helping to meet the international community’s aid and development goals. The system may not be perfect, but efforts are afoot to improve it at many levels.

For the Silo, Lawrence Herman/C.D. Howe Institute.

The author thanks Daniel Schwanen, Charles-Emmanuel Côté, Rick Ekstein, Ari Van Assche, Gus Van Harten and anonymous reviewers for comments on an earlier draft. The author retains responsibility for any errors and the views expressed.

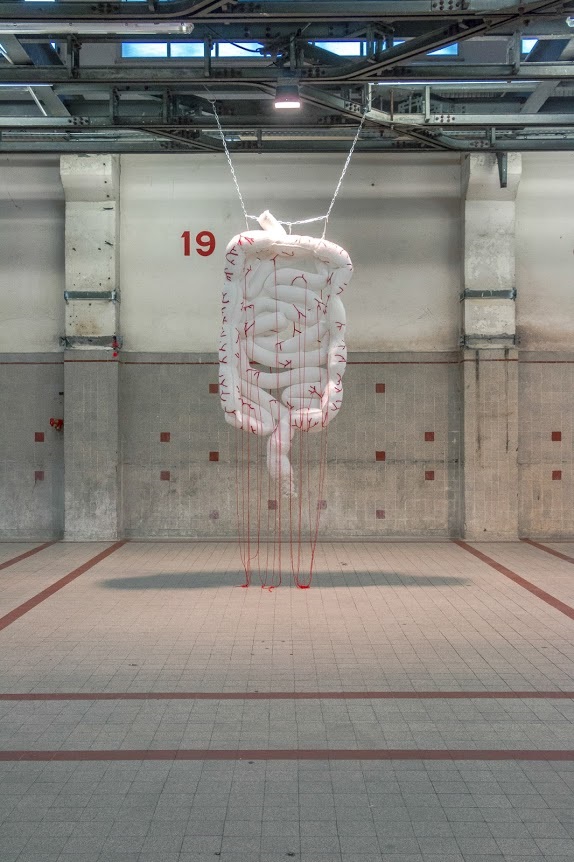

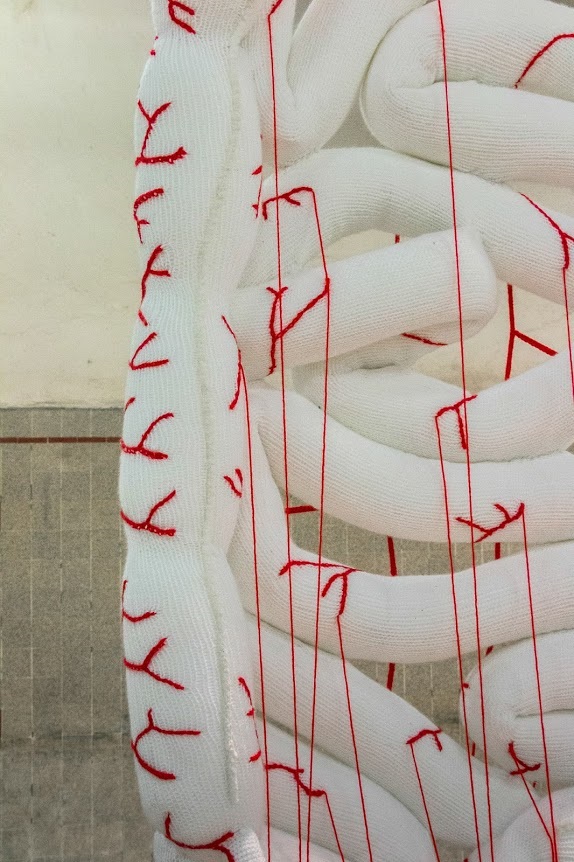

Why crochet? Rolled cigarette in mouth, she passes a nonchalant hand into blond spiky hair. She thinks… “This practice is also ancestral, but has potential for feminist messages and aesthetics when it is diverted from its original use and put towards the service of art. I’ve always been very creative and a little hyper active yet the only compliment I could expect from that was to be commended for being a good mother…”. I got fed up.” Reduced once too often to the status of “the good historical female”, Stéphanie Lobry “lost it”and held her first exhibition.

Why crochet? Rolled cigarette in mouth, she passes a nonchalant hand into blond spiky hair. She thinks… “This practice is also ancestral, but has potential for feminist messages and aesthetics when it is diverted from its original use and put towards the service of art. I’ve always been very creative and a little hyper active yet the only compliment I could expect from that was to be commended for being a good mother…”. I got fed up.” Reduced once too often to the status of “the good historical female”, Stéphanie Lobry “lost it”and held her first exhibition.