January 1st kicked off 2017 with significant gasoline price hikes at the pumps courtesy the Ontario Liberal government’s cap and trade legislation. I obviously voted against that bill.

Ontario’s cap and trade, Canada’s price on carbon

Another reality is that Canada is putting a price on carbon, the nature of which is still being negotiated with the provinces. With national carbon pricing being the new reality, Opposition Leader Patrick Brown has written an open letter to Justin Trudeau indicating that Kathleen Wynne’s cap and trade law “does not have Ontario’s best interests at heart,” and requesting that Ontario cap-and-trade be removed from the Trudeau carbon pricing system. I’m not holding my breath on that one.

The problem with the provincial cap and trade tax and the federal price on carbon is that going electric is neither technologically nor economically feasible for most, thanks to the Ontario Liberal’s Green Energy Act. I also voted against that bill. The cap and trade tax system serves as a stick to try and modify behavior without offering a viable alternative and without a carrot to reward changes made, other than using the revenue for more subsidies for things like electric cars and Toronto transit.

As Ontario’s Official Opposition we have committed to dismantle the cap and trade system ever bearing in mind the federal government is mandating all provinces put a price on carbon.

On January 1, the province capped greenhouse emissions and will sell allowances to companies who have to exceed the cap. The province will lower the cap over time. Companies exceeding their cap can also buy additional allowances, or if they come in below their annual limit, can sell their emission allowances to other companies within a market comprised of Ontario, Quebec and California.

It is estimated Ontario businesses will be paying $300 million a year to California.

We maintain the government is so desperate to hike taxes, they have rejected a revenue-neutral plan – cap-and-trade money will disappear into general revenues.

Cap and trade has clearly not been designed to return money to those paying – it is a blatant $2 billion-a-year tax grab under the guise of environmentalism. It will seriously impact everyone’s pocket book. Oil refineries for example will pass their recovery costs of cap and trade to their customers at the pumps. It subtracts money from people, not only for gasoline, diesel, propane, natural gas, heating oil and aviation fuel but also for groceries, clothing and other consumer goods produced and delivered by carbon-fueled plant, equipment and transportation.

Ontario’s Auditor General reports the cap and trade tax will cost families an extra $156 this year for gasoline and natural gas, rising to $210 by 2019. Added transportation costs for goods and services will be another $75 per household by 2019.

We are committed to dismantling the cap and trade scheme and the Green Energy Act. This is the best way to ensure people’s hard-earned money stays exactly where it should stay…in their pockets.

In conclusion, I ask you the reader – where do we go from here? There probably won’t be an election until June 2018 and this is the time to consult on policy.

Provincially, the Ontario PC Party has committed to dismantle the Wynne cap and trade law, as well as the Green Energy Act. However, carbon pricing is now the reality in Canada and Ontario will be bound by the Trudeau price on carbon. For the Silo, Haldimand-Norfolk MPP Toby Barrett.

Barrett questions constitutionality of carbon tax legislation

QUEEN’S PARK – Haldimand-Norfolk MPP questioned the constitutionality of the federal government’s carbon tax legislation during Question Period in the Ontario Legislature today.

“While we know that the Trudeau Liberals’ carbon tax will obviously drive up the costs of goods and services we all rely on every day, some have been asking what is the rationale for participating in two challenges,” Barrett said. “Can the Attorney General share with this House why participating in two challenges is important?”

Attorney General Caroline Mulroney answered, “Our ask of the Ontario Court of Appeal is to provide advice on whether or not the federal carbon tax is unconstitutional in whole or in part. Our legal team is going to work hard and has been working hard to build our case, and our government is confident in our position and that we will win.”

Legislation introduced last week in regards to cancelling the cap-and-trade legislation, if passed, would:

· repeal the failed Cap-and-Trade legislation

· protect taxpayers from further costs

· set out regulation-making authority for a compensation framework

· and requires the Ontario government to develop a climate change plan that reports back on progress.

During the exchange in Barrett’s supplementary question, it was revealed the government will be asking the Ontario Court of Appeal if the federal carbon tax is unconstitutional. Mulroney also reported the challenge will cost less than initially thought.

For more information, contact MPP Toby Barrett at 519-428-0446 or toby.barrett@pc.ola.org Please mention The Silo when contacting.

ONTARIO LEGISLATIVE ASSEMBLY

DRAFT HANSARD

Tuesday, Aug. 7, 2018

TAXATION

Mr. Toby Barrett: To the Attorney General: Last Thursday our government announced, in keeping with our commitment to people in Ontario, that we’re launching our own challenge of the federal carbon tax in the Ontario Court of Appeal—a challenge we can win. This announcement was made a few short weeks after the Premier announced that Ontario will also be participating in Saskatchewan’s challenge in the Saskatchewan Court of Appeal.

While we know that the Trudeau Liberals’ carbon tax will obviously drive up the costs of goods and services we all rely on every day, some have been asking what is the rationale for participating in two challenges? Can the Attorney General share with this House why participating in two challenges is important?

Hon. Caroline Mulroney: I am happy to clarify the necessity of this approach. Ontario is working co-operatively with Saskatchewan to ensure that both provinces’ references proceed as efficiently and as affordably as possible. Combined with our partners in Saskatchewan, our ask of our respective courts of appeal will allow for a broad consideration of all possible arguments regarding the validity of the federal carbon tax.

Anywhere the federal carbon tax is being constitutionally challenged, we want to be a part of that fight, Mr. Speaker. We believe this approach can only increase our likelihood of success. We were elected with a mandate to stand up for Ontario taxpayers, and that’s exactly what we’re doing.

Interjections.

The Speaker (Hon. Ted Arnott): Members will please take their seats.

Supplementary.

Mr. Toby Barrett: Through you, Speaker, I would like to thank the Attorney General for that explanation. We all realize …

… Supplementary.

Mr. Toby Barrett: Through you, Speaker, I would like to thank the Attorney General for that explanation. We all realize it’s important we stand up for people in Ontario. I know this government is working hard to do just that. I also know it’ll be a great day when we win this challenge for the people of Ontario.

To that end, I’m wondering if the Attorney General can speak a bit more about the benefits of our government’s efforts and what we can see to benefit people in Ontario.

Hon. Caroline Mulroney: Through you, Mr. Speaker, I want to thank the member from Haldimand–Norfolk for the follow-up question.

I agree wholeheartedly with his comments. Challenging the Trudeau Liberals’ carbon tax is important. Our government campaigned on a promise to the people that we would work hard to put money back in taxpayers’ pockets and bring real relief back to families. By challenging the federal carbon tax, we’re working hard to deliver on these commitments.

As I said in this House last week, our ask of the Ontario Court of Appeal is to provide advice on whether or not the federal carbon tax is unconstitutional in whole or in part. Our legal team is going to work hard and has been working hard to build our case, and our government is confident in our position and that we will win.

I’m also confident that this challenge, which will be using in-house lawyers at the Ministry of the Attorney General, will cost significantly less than initially thought. Our government knows that this challenge will protect the hardworking people of Ontario……

QUEEN’S PARK – Today Haldimand-Norfolk MPP Toby Barrett tabled a motion in the Ontario Legislature calling on the government to provide relief for Ontario taxpayers.

Barrett’s motion read: That in the opinion of this House, the Ontario government should reduce taxes where feasible, and not introduce any new provincial taxes or raise existing provincial taxes – including, but not limited to, any personal income taxes, business taxes, corporate taxes, or carbon taxes.

Tabling the motion is the first step in the process for a Private Member’s Motion. Barrett’s motion will be debated in the Legislature on Thursday.

For more information contact MPP Toby Barrett at 519-428-0446 or toby.barrett@pc.ola.org

Tax or No Tax? – Facts Still Matter in Ontario

Patrick Brown has done it again.

This time, not only has he spread misinformation across the province in an interview with CTV Ottawa, but he seems to be flip flopping on his one and only policy proposal – a carbon tax.

Facts Still Matter in Ontario, and Patrick Brown needs to stick to them.

He claimed: “Well, I don’t support raising taxes.”

Fact: Wrong – Patrick Brown supports a carbon tax.

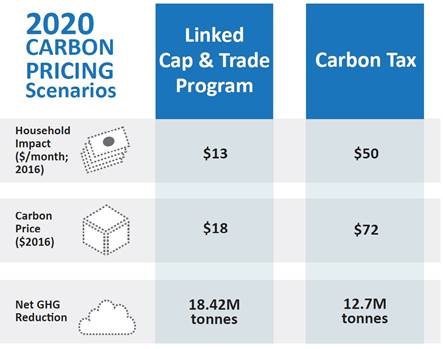

Worse, he supports it despite knowing that independent, third-party experts have proven his carbon tax scheme would be more expensive and less effective than our plan to cap the pollution businesses can release into the atmosphere. Unlike his scheme, our approach guarantees emission reductions at the cheapest price possible for people and the economy.

(Source: http://kicx106.com/new-billboard-takes-aim-patrick-brown-carbon-tax/; https://www.enviroeconomics.org/single-post/2016/05/17/Impact-Modelling-and-Analysis-of-Ontario%E2%80%99s-Proposed-Cap-and-Trade-Program)

He claimed: “Well, I care about the environment.”

Fact: Whether it’s voting against the Greenbelt Act, Great Lakes Protection Act, Places to Grow Act, the Climate Change Mitigation and Low-Carbon Economy Act or more, the Conservatives have a track record of doing more harm than good for Ontario’s environment.

(Source: http://www.ontla.on.ca/web/bills/bills_all.do?locale=en&parlSessionID=41%3A2&go=go)

He claimed: “Right now you’ve got a government that doesn’t monitor the infrastructure projects properly. The Auditor General said we could see giant cost overruns, because we don’t measure performance…”

Fact: Independent 3rd party organizations have confirmed that our infrastructure procurement model is successful, finding that 96% of our projects have been completed on budget. The AFP model we’ve implemented has also saved the province $6.6 billion. The Auditor General even recognized this in her report.

(Source: http://www.infrastructureontario.ca/Third-Party-Reports/)

He claimed: “The Pickering bridge – they built part of the bridge upside down, they gave the company a contract who had never built a bridge and they built it upside down”

Fact: We know Patrick can find the facts to be topsy turvy, but the Pickering bridge was not built upside down. The former Metrolinx CEO was pretty clear about that.

(Source: https://www.thestar.com/news/gta/2016/12/04/pickering-pedestrian-bridge-ran-into-trouble-early-on.html)

He claimed: “Mental health – you look at the short funding of mental health that municipalities have had to pick up because of the provincial Liberals”.

Fact: Our government continues to provide record mental health supports for people across the province. As part of Budget 2017, we built on our previous investments by expanding access to psychotherapy, supporting access to mental health and addictions services for post-secondary students and providing free prescription medications for those 24 years of age and younger through OHIP+.

(Source: https://news.ontario.ca/maesd/en/2017/05/ontario-boosts-mental-health-supports-for-people-across-the-province.html)

Note:

It’s important to give credit where credit is due. So thank you Patrick for correctly stating our government’s infrastructure investment figure. At $190 billion it’s the largest infrastructure investment in the history of the province. And that’s a fact.

Facts Still Matter in Ontario – Aug 1, 2017

Over the weekend, Patrick Brown decided to go back to his roots and continue misleading Ontarians and the media about basic information. He needs to remember that Facts Still Matter in Ontario.

He claimed: “I’m not going to settle for an Ontario that’s a have not province…That gets equalization payments”

Fact: In 2016-17 Ontario paid $6.9 billion into the equalization program and only received $2.3 billion from it. In addition, according to the Mowat Centre, “Ontarians have consistently contributed more to the federal government in total tax revenue than they have received in federal spending in return.”

(Source: https://mowatcentre.ca/mind-the-gap/)

He claimed: “I talk to a small business and they’re telling me that they’re struggling right now to stay afloat whether it’s hydro rates or red tape”

Fact: Patrick Brown voted against reducing small businesses electricity bills by 25% and he opposes our efforts to reduce red tape

(Source: http://www.ontla.on.ca/web/house-proceedings/house_detail.do?Date=2017-5-31&Parl=41&Sess=2&locale=en#para862)

He claimed: “[cap and trade] is a 1.9-billion-dollar cash grab”

Fact: Wrong. Putting a cap on the pollution businesses can release into the atmosphere guarantees emission reductions at the cheapest price possible for people and the economy. It’s the best approach forward for Ontario. Every dollar generated will be deposited in a dedicated account and reinvested into green projects like transit, electric vehicle incentives and housing retrofits that fight climate change. This means every dollar goes back into helping families and businesses successfully make the transition to a low-carbon economy. As announced in June, hundreds of millions of dollars have already been reinvested.

(Source: https://news.ontario.ca/ene/en/2017/06/ontario-announces-results-of-june-cap-and-trade-program-auction.html)

Fact: Patrick Brown should also know that independent, third-party experts have proven his carbon tax scheme would be more expensive and less effective than our plan. Every dollar also goes back into helping families and businesses successfully make the transition to a low-carbon economy.

cid:image001.jpg@01D309F3.2683EF80

(Source: https://www.enviroeconomics.org/single-post/2016/05/17/Impact-Modelling-and-Analysis-of-Ontario%E2%80%99s-Proposed-Cap-and-Trade-Program)