I’m sure we all read the distressing poll that about a third of Canadians still don’t believe the threat of climate change is real. Even more illuminating: only 30 per cent even know we are taking action in Ontario to fight climate change.

This is the reason why Canada and Ontario are working together to take action on climate change and find clean solutions to help homeowners and families save money, reduce energy waste, create jobs and support healthy communities.

Minister of Environment and Climate Change, Catherine McKenna, and the Premier of Ontario, Kathleen Wynne, announced a federal investment of up to $100 million to help the people of Ontario make energy efficient retrofits to their homes – including apartments, townhouses and low-income housing – and businesses.

This funding will support the province’s GreenON Rebates program, which helps cover the cost of eco-friendly retrofits across the province. This investment is supported by the Government of Canada’s Low Carbon Economy Leadership Fund.

GreenON Rebates will assist property owners make energy efficient changes like installing better insulation, high-efficiency ventilation systems and heat pumps, and other devices to save energy and reduce costs.

This is an opportunity for us here in Haldimand-Norfolk to take action and do our part in fighting the climante change. We can take advantage of receiving some of our own tax dollars back by improving our houses and businesses while saving money in the long run at the same time.

As part of its Climate Change Action Plan (CCAP), Ontario in investing up to $1.7 billion over the coming years into GreenON to support a wide range of programs, including rebates and programs to help families, business and farmers make environmentally friendly changes. The CCAP is a five-year action plan that is making life more affordable for people across the province and making Ontario a leader in the global fight against climate change. Revenues from Ontario’s carbon market, which puts a cap on the carbon pollution businesses can emit, are funding this action plan.

The Government of Canada’s Low-Carbon Economy Leadership Fund provides $1.4 billion to provinces and territories that have adopted the Pan-Canadian Framework on Clean Growth and Climate Change (PCF), to deliver on commitments to reduce greenhouse gas emissions. Today’s announcement is part of the almost $420 million Ontario is receiving through the Leadership Fund.

Did you Know:

- Through GreenON, property owners are currently eligible for rebates up to $7,200 in savings on new insulation; $5,000 in savings on replacement windows; $5,800 in savings on some air source heat pumps; and $20,000 in savings on installation of some certified ground source heat pumps.

- In January, Ontario became part of the second-largest carbon market in the world, which forms the backbone of Ontario’s strategy to cut greenhouse gas pollution to 15 per cent below 1990 levels by 2020, 37 per cent by 2030 and 80 per cent by 2050.

- Ontario’s carbon market has generation approximately $2.4 billion in revenue to improve schools, hospitals, transit and other projects like new bike lanes that are building a greener, more energy efficient province.

- Ontario has committed up to $1.7 billion over three years to support a wide range of programs under the Green Ontario Fund (GreenON).

A plan to create a more competitive business environment

FOR IMMEDIATE RELEASE:

Nov. 7, 2019

QUEEN’S PARK – Ontario’s plan to create a business environment that attracts

investment and creates high-paying, good quality jobs was outlined by Finance

Minister Rod Phillips in the Fall Economic Statement.

Ontario is a province of tremendous opportunity and potential however, high taxes,

excessive payroll costs and burdensome red tape have been driving investment and

jobs away from the province. That is why the government is creating the conditions

for success by reducing taxes and eliminating outdated and duplicative regulations,

while making sure important health, safety and environmental protections are

maintained or enhanced.

“We are empowering small business by allowing them to compete without competing

against high taxes and sticky red tape,” said Toby Barrett, MPP.

To help small businesses grow and succeed, the government is proposing to reduce the

small business Corporate Income Tax rate to 3.2 per cent from 3.5 per cent, starting

January 1, 2020, fulfilling the promise to cut Ontario’s small business tax rate by

8.7 per cent. This measure would provide tax relief of up to $1,500 annually to over

275,000 businesses that benefit from the small business Corporate Income Tax rate –

from family-owned shops to innovative start-ups.

Overall, Ontario’s small businesses would save $2.3 billion in 2020 through actions

the government is taking such as cancelling the cap-and-trade carbon tax, keeping

the minimum wage at $14 per hour, and supporting Workplace Safety & Insurance Board

(WSIB) premium reductions.

For more information, contact MPP Toby Barrett at 519-428-0446 or

toby.barrett@pc.ola.org Please mention The Silo when contacting.

Terminating Ontario’s cap-and-trade carbon tax

Ontario’s carbon tax era is over. Cancelling cap-and-trade is not only the right thing to do; it is also an important step to saving money on fuel and kick starting the economy.

Under the previous government, Kathleen Wynne’s cap-and-trade carbon tax made Ontario unaffordable and uncompetitive, and added 4.3 cents per litre to the cost of gasoline. Provincial government legislation, to bring end to the tax, will help Ontario to become once again the economic engine of Canada.

The Ontario government was elected on a clear mandate: to put people first and make life more affordable for families. Eliminating the cap and trade carbon tax will save the average family $260 each year.

We understand the seriousness of climate change, but we do not believe the solution is a regressive tax – a punishing tax that forces poor and middle-class Ontario families to pay more for necessities like heating their homes or fuelling their vehicles. It’s a job-killing tax imposing new costs on business and suffocating our economy during these uncertain times.

Over this summer, we passed provincial legislation to lower the cost of gasoline by 4.5 cents a litre and diesel by 5.5 cents a litre. Further, as of October, we will see an annual household savings on natural gas bills of $70 a year.

We’re launching our own challenge of the federal carbon tax in the Ontario Court of Appeal – a challenge we can win. This announcement was made a few short weeks after the Premier announced Ontario would also be participating in Saskatchewan’s challenge in its Court of Appeal. This summer I had an opportunity to rise in the House, during question period, to ask Ontario’s Attorney General to explain the rationale for being involved in two legal challenges.

As Attorney General, Caroline Mulroney clarified: “Ontario is working cooperatively with Saskatchewan to ensure that both provinces’ references proceed as efficiently and as affordably as possible.” She continued to explain this partnership will allow for a broad consideration of all possible arguments regarding the validity of the federal carbon tax. “Anywhere the federal carbon tax is being constitutionally challenged, we want to be a part of that fight,” she said.

The Ontario Court of Appeal will rule on whether or not the federal carbon tax is unconstitutional in whole or part. The Attorney General will be conducting this challenge using in-house lawyers, which will reduce the associated costs significantly.

The legislation also includes provisions that would allow for the continuation of Ontario’s greenhouse gas emissions reporting program and establish targets to reduce emissions in the province. The regulation requires the government to make the reduction targets available to the public. It will also see our government prepare a new climate change plan — a made-in-Ontario solution that addresses our challenges.

Make no mistake — the people of Ontario have done a lot. Our riding of Haldimand-Norfolk has done a lot, taking a big hit for the team when the previous government shut down Nanticoke – one of the world’s largest coal-fired generating stations and significant economic driver in our area.

There is still much to be done. We continue to take measures to protect people and promote prosperity.

We are moving past the previous government’s obsession with raising taxes. Instead, we are developing an environmental plan that will work.

Toby Barrett MPP for Haldimand-Norfolk

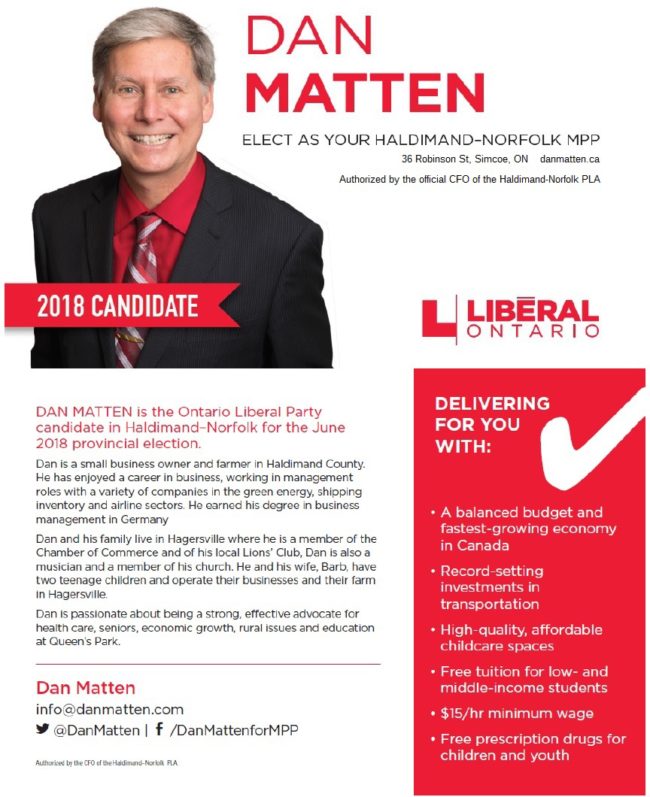

This morning, I put up my first campaign sign at the home of former Haldimand-Norfolk MPP Gord Miller.

Gord Miller was elected to the Ontario legislature in the 1975 provincial election, defeating Progressive Conservative candidate Jim Allan and became MPP. He was re-elected in the 1977 election, and again in 1981, 1985 and 1987 and served until 1990.

Gord and I met several times to discuss the needs and issues of our riding and the need for change of representation after 22 years in Haldimand-Norfolk.

I feel privileged that Gord has endorsed me by saying I am “a man of the future.”

Contact me at my campaign office at 36 Robinson St. in Simcoe to request your sign. Or call me at 510-410-4024.