Whether you wish to improve your living space or you are going to sell your home, a home renovation will add instant value to your property.

Many home buyers are looking for homes that are ‘move in ready’ and don’t require much or any work prior to moving in. Because of this desirability, many homeowners are deciding to make upgrades to their home to increase the resale value. If you have a number of projects in mind that are on your ‘wish list’, but aren’t sure which one to start with, you might find these suggestions helpful.

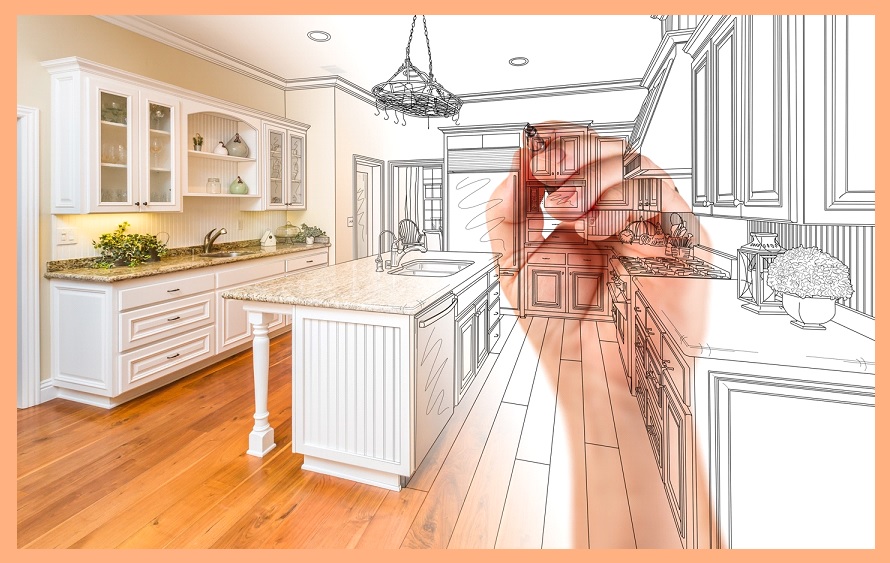

- Kitchen Remodel – This is probably the biggest project that you will undergo, but the one that has the most impact. The kitchen is the most used room in a house and the central hub for most activities. Thus, it makes sense to have a kitchen that is both functional and attractive. If the cabinets are old looking and the countertops are in poor condition, it is hard to overlook. For some, a major renovation might be out of reach, but there are smaller scale options that will also work to spruce up the appearance. You can add a fresh coat of paint or even just reface the cabinetry with new wood panels and hardware. Overall, you can likely recoup 60% to 80% of the cost of the kitchen remodel.

- Garage Door Replacement – A garage door makes a great design element to your home as it is one of the first things people see when they come to your home. Although it doesn’t always top the list of most popular projects, it should not be overlooked in terms of overall home value and curb appeal. Over 80% of Realtors believe a new garage door can impact home value – all the more reason to take on this project.

- Fiberglass Entry Door Replacement – Nothing makes a more impactful statement than the attractiveness of your front door. Replacing the standard fiberglass entry door to something more stylized to your home will add to the ‘first impression’ element of your home. There are many attractive alternatives for a front door and finding a suitable design that goes with the home will add value straight away without having to undergo a major renovation. According to a recent study, replacing your front door has an average ROI of 75%.

- Window Replacement – Having old windows with cracked or chipped frames greatly affects the look of your home. Potential buyers will notice them and so do appraisers. If you’ve got questions about buying new windows, get the answer from a reputable company before you buy. Replacing the windows in your home can add thousands of dollars to its market value, and with an average ROI of up to 85%, so it makes sense to consider it as a priority upgrade option, especially if you are planning on selling in the near future.

- Deck Addition – A wood deck addition falls on the inexpensive side of remodeling projects, but it’s one of the more valuable. In fact, some experts claim that installing a deck can increase the value of your home significantly more than if you were to add another bathroom or living room at a fraction of the cost. The overall cost of installing a deck will largely depend on the size of the deck and material you use. However, most homeowners will recoup nearly 70% of the build cost after they have sold their home.

If you want to take on any of these home improvement projects, but don’t have the immediate cash on hand to make them a reality, then a home improvement loan might be something to consider.

What is a home improvement loan?

A home improvement loan can be a home equity loan, a HELOC loan, or any loan using home equity used for home improvement purposes. Borrowers will typically use these types of loans to access the capital they need to build on their investment.

According to a recent study, the value of residential mortgage loans from alternative lenders is steadily growing. Canadians are choosing to opt-out of traditional lenders’ extended waiting periods and paperwork and are finding that working with a mortgage broker is an easier, more streamlined process that saves time, effort and money. If you are a homeowner considering a renovation to your home, a reputable broker such as Burke Financial can help you with every stage of the process.